Emergency Fund: Why You Need it in 2025 (and How to Build One Fast)

“If your salary stopped tomorrow, how many days could you survive without borrowing?”

An emergency fund—often called a rainy day fund, financial cushion, or contingency fund—isn’t just a nice-to-have; it’s a lifeline. In today’s unpredictable economy, unexpected expenses like job loss, medical bills, or sudden home repairs can throw your finances into chaos. Having a dedicated emergency fund ensures you stay afloat without relying on credit cards, loans, or borrowing from friends and family.

In this comprehensive guide to building your emergency fund in 2025, we’ll walk you through:

- What an emergency fund really is and why it matters more than ever.

- How much money you should save depending on your lifestyle and income.

- Where to keep your emergency savings so it’s safe but accessible.

- Practical steps to build your fund faster without feeling overwhelmed.

- Common mistakes to avoid, like locking it away in risky investments or dipping into it for non-emergencies.

By the end, you’ll know exactly how to set up a rock-solid financial safety net that protects you and your family no matter what life throws your way.

Table of Contents

What Is an Emergency Fund (And Why It’s Different from Savings)?

An emergency fund is a dedicated pool of money set aside to cover unexpected, necessary, and urgent expenses. Think of it as your financial safety net—money you can immediately access without taking on debt when life throws a curveball. While it’s often confused with regular savings, an emergency fund serves a very different purpose.

Emergency Fund vs. Rainy Day Fund vs. Investments

- Emergency Fund: Reserved strictly for major, life-impacting situations such as job loss, medical emergencies, or urgent car repairs. It’s meant to cover 3–6 months of essential living expenses.

- Rainy Day Fund: A smaller cushion for minor but inconvenient expenses—like replacing a broken microwave, paying for a surprise school trip, or fixing a flat tire.

- Investments: Assets like stocks, real estate, or retirement accounts designed for long-term growth. These are not suitable for emergencies because their value can fluctuate, and accessing them quickly may result in penalties or losses.

The golden rule: Keep your emergency fund liquid, safe, and separate from your investments.

The 3-Question Test for Emergencies

Before dipping into your emergency fund, ask yourself these three questions:

- Is it unexpected?

- Example: Your roof leaks after a storm – Yes

- Not an emergency: Holiday shopping

- Example: Your roof leaks after a storm – Yes

- Is it necessary?

- Example: Paying for urgent medical treatment – Yes

- Not an emergency: Upgrading to the newest smartphone

- Example: Paying for urgent medical treatment – Yes

- Is it urgent?

- Example: Car repair needed to get to work – Yes

- Not an emergency: Booking a last-minute vacation

- Example: Car repair needed to get to work – Yes

Real-Life Examples: True Emergencies vs. False Emergencies

True Emergencies:

- Sudden job loss leaves you without income.

- Emergency surgery or unexpected hospital bills.

- Essential home repairs (like a burst water pipe).

- A car breakdown prevents you from getting to work.

False Emergencies:

- A wedding gift you forgot to budget for.

- Seasonal sales or limited-time shopping deals.

- Routine expenses you didn’t plan properly (e.g., annual car insurance).

By setting clear rules, you’ll protect your emergency fund from being drained by everyday wants or poor planning, ensuring it’s there when you truly need it.

Why Emergency Funds Are More Critical in 2025

1. Rising Inflation & Cost Pressures (India + U.S.)

- United States: Inflation, though moderated from extreme levels, remains a real challenge. Core inflation currently hovers around 3.1%, with overall inflation near 2.7%, continuing to squeeze household budgets and shrink saving capacity—even for essentials like food and dining out. A WalletHub survey shows 44% of Americans say inflation prevents them from saving for emergencies, while 51% cite insufficient income as the main barrier.

- India: Saving trends are no less worrying. Nearly half of Indians surveyed save less than 10% of their income, and roughly three out of four don’t have an emergency fund at all. Among high-net-worth individuals (HNIs), 14% admit to having absolutely no emergency reserve, despite substantial wealth.

2. Job Market Volatility & Income Instability

- In the U.S., the unemployment rate was 4.2% in May 2025, but projections suggest it could climb to 4.6%–6% in downside scenarios. Meanwhile, long-term unemployment rose by 190,000, totaling 1.6 million, and Gen Z faces a staggering 14.4% unemployment rate, more than double the national average.

- Globally, unreliable work schedules—especially in retail, gig, or hourly segments—add layers of financial risk. Fluctuating income makes it tough to plan or save consistently.

3. Psychological Benefit: Peace of Mind & Stress Reduction

- Backed by Vanguard research, having just $2,000 in emergency savings is associated with a 21% higher level of financial well‑being; those with three to six months’ worth of buffers report an additional 13% increase.

- Those with emergency funds spend about 3.7 hours per week dealing with finances, compared to 7.3 hours for those without—offering clear mental and emotional relief.

4. Alarming Statistics: Many People Have No Safety Net

- United States:

- 24% of Americans have no emergency savings at all, according to Bankrate’s 2025 Annual Emergency Savings Report.

- Another survey confirms that nearly 1 in 4 Americans lack any emergency savings, while 46% can’t cover even three months of expenses, and 37% tapped their savings in the past year.

- Empower’s findings show 21% of Americans have no emergency savings, while 37% couldn’t afford a $400 emergency, and the median buffer is just $600.

- 24% of Americans have no emergency savings at all, according to Bankrate’s 2025 Annual Emergency Savings Report.

- India: As mentioned earlier, about 75% of Indians lack any emergency fund, and 47% save under 10% of their income.

Why It All Matters in 2025

In today’s economic landscape, marked by continued inflation, labor market fragility, and global uncertainties—often dubbed a period of “revenge saving” —people are pivoting toward liquidity and resilience. An emergency fund isn’t optional anymore; it’s essential. It helps you:

- Navigate sudden job loss or income dips.

- Cushion against rising living costs.

- Safeguard your mental health by reducing financial stress.

- Avoid falling into debt or tapping retirement/k investment.

How Much Should You Save? (Personalized, Not One-Size-Fits-All)

When it comes to your emergency fund, there isn’t a magic number that works for everyone. The “right” amount depends on your income, lifestyle, and financial responsibilities. Still, there are some trusted benchmarks you can use as a guide.

Step 1: Hit the Starter Milestone

If you’re just beginning, aim for a starter fund of $1,000 (around ₹50,000). This small cushion can cover unexpected expenses like a medical bill, car repair, or appliance replacement without throwing you into debt.

Think of this as your first line of defense. Once you’ve reached it, you can focus on building a more substantial safety net.

Step 2: The Standard Rule (3–6 Months of Expenses)

Most financial experts recommend saving enough to cover three to six months of essential expenses. This means your rent or mortgage, groceries, utilities, insurance, transportation, and other must-haves—not luxuries like vacations or dining out.

For example, if your core monthly expenses are $2,000 (₹1.5 lakh), you’d need between $6,000–$12,000 (₹4.5–₹9 lakh) to stay secure in case of job loss or a health crisis.

Step 3: Extended Cushion for Extra Security

For some people, the standard rule isn’t enough. If you fall into one of these categories, you’ll want a bigger emergency fund:

- Freelancers & Gig Workers: Income can fluctuate month to month. Aim for 9–12 months of expenses.

- Self-Employed Business Owners: A downturn in business could dry up your income. Target 12–18 months.

- Retirees: Without a steady paycheck, a larger cushion provides peace of mind—12+ months is ideal.

Emergency Fund Calculator:

💰 Emergency Fund Calculator

Emergency Fund Calculator Table

Here’s a quick reference to estimate your emergency savings based on monthly expenses:

| Monthly Expenses | 3 Months | 6 Months | 12 Months |

| $1,500 (₹1.2 lakh) | $4,500 (₹3.6 lakh) | $9,000 (₹7.2 lakh) | $18,000 (₹14.4 lakh) |

| $2,000 (₹1.5 lakh) | $6,000 (₹4.5 lakh) | $12,000 (₹9 lakh) | $24,000 (₹18 lakh) |

| $3,000 (₹2.3 lakh) | $9,000 (₹6.8 lakh) | $18,000 (₹13.6 lakh) | $36,000 (₹27.2 lakh) |

| $4,000 (₹3 lakh) | $12,000 (₹9 lakh) | $24,000 (₹18 lakh) | $48,000 (₹36 lakh) |

Step 4: Customize Based on Your Situation

Your emergency fund should reflect your unique financial reality. Ask yourself:

- Job Stability: Do you work in a secure industry, or is your job vulnerable to layoffs?

- Family Size: A single person can manage with less; a family of four needs more.

- Health Needs: Ongoing medical expenses require a larger buffer.

- Geography: Living costs vary—urban centers usually demand bigger safety nets.

By adjusting for these factors, you’ll avoid both extremes—being underprepared or over-saving at the cost of other financial goals.

Where Should You Keep Your Emergency Fund?

Core Principles

Your emergency fund must balance three essentials:

- Liquidity — accessible at a moment’s notice

- Safety — protected from market swings and losses

- Accessibility — easy to withdraw without hassle or penalties

Best Storage Options (with Updated Insight & Citations)

High-Yield Savings Accounts (U.S.)

- Pros: FDIC-insured (up to $250,000), offers strong APYs ranging between 4%–5% as of mid-2025, flexible access.

- Cons: Rates are variable—subject to federal rate changes—and some may impose minimum balances or transaction limits.

Money Market Funds

- Pros: Generally more yield than standard savings, still fairly liquid.

- Cons: Not FDIC-insured, and returns can vary with market conditions.

Fixed Deposits (FDs in India)

- Pros: Offer guaranteed interest for a fixed term; safer than equity investments.

- Cons: Penalties apply for early withdrawal — interest can drop by 0.5% to 1% (sometimes more) if withdrawn prematurely.

Liquid Mutual Funds (India)

- Pros: Redeemable within 24 hours, typically yield more than savings accounts.

- Cons: Not entirely risk-free; NAV can slightly fluctuate.

Small Buffer in Checking Account

- Pros: Instant access for immediate needs.

- Cons: Typically earns negligible interest; higher temptation to overspend.

What to Avoid

- Stocks & Cryptocurrencies – volatile, not suited for emergencies

- Retirement Accounts (e.g., 401(k), EPF, PPF) – penalties and tax implications often apply on early withdrawal

- Long-term Investments or Real Estate – too illiquid when you need funds quickly

Comparison Table

| Account Type | Safety | Liquidity | Typical Returns | Best For |

| High-Yield Savings (US) | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | 4–5% APY | Fast, insured access to funds |

| Money Market Funds | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | Moderate yields | Conservative growth, moderate access |

| Fixed Deposits (India) | ⭐⭐⭐⭐⭐ | ⭐⭐ | Fixed rates (~6–7%) | Guaranteed return, disciplined saving |

| Liquid Mutual Funds (India) | ⭐⭐⭐⭐ | ⭐⭐⭐⭐ | Generally better than savings | Quick redemption + return balance |

| Checking Account Buffer | ⭐⭐⭐⭐⭐ | ⭐⭐⭐⭐⭐ | Very low (≈0%) | Immediate liquidity for small expenses |

Your emergency fund is about reliability, not growth. Keep the bulk of it in safe, liquid options — high-yield accounts or liquid mutual funds — and hold a small part in your checking for immediate access. Avoid speculative or long-term assets that could delay access or result in penalties.

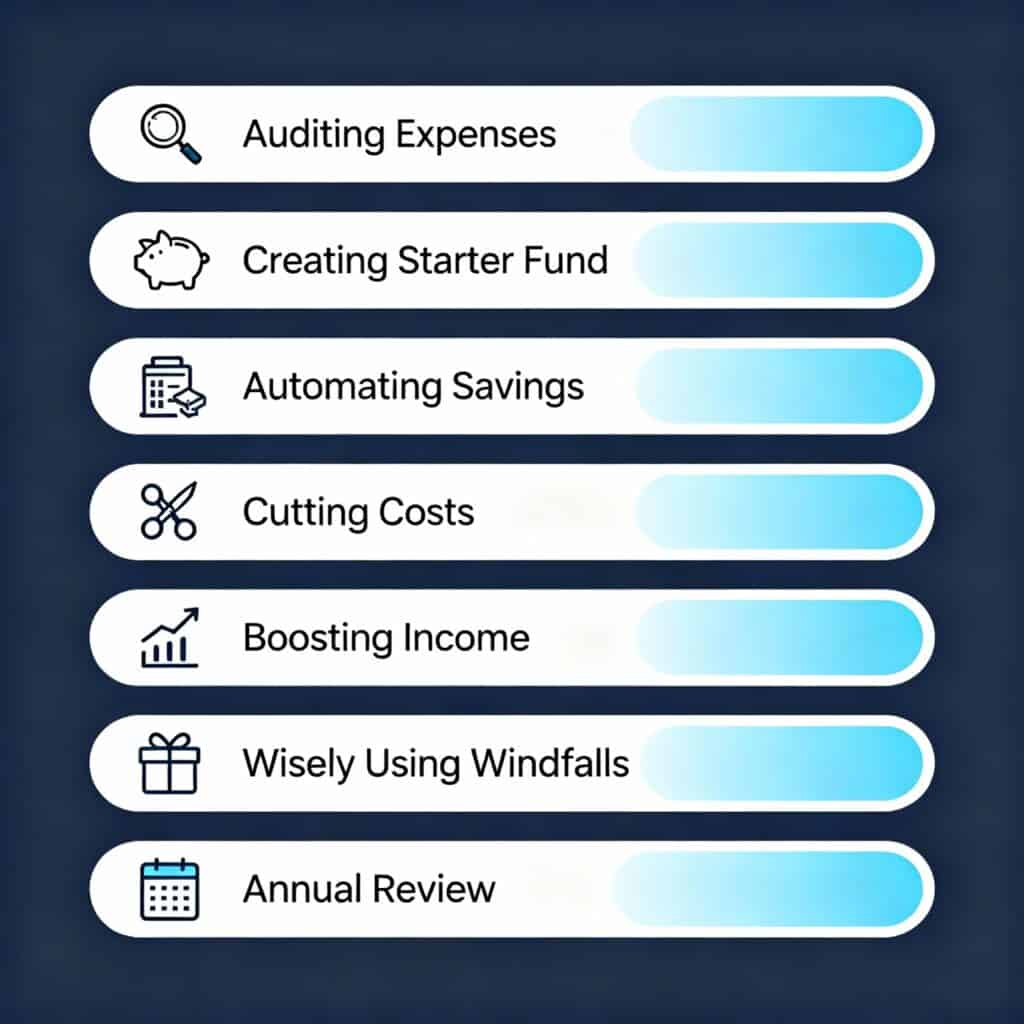

Step-by-Step: How to Build Your Emergency Fund From Zero

Building an emergency fund might feel overwhelming, especially if you’re starting from scratch. But the truth is, anyone can do it with a clear plan and consistent effort. Here’s a practical roadmap to help you create your financial safety net from the ground up.

1. Audit Your Essentials

Start by calculating your must-have expenses—the bills you can’t skip. This includes:

- Rent or mortgage payments

- Groceries and household items

- Utilities (electricity, water, internet)

- Transportation (fuel, metro, or car maintenance)

- Insurance premiums and medical needs

This gives you a realistic idea of how much you’d need to survive one month without income. It’s also the foundation for setting your emergency fund target.

2. Set a Starter Goal

Don’t aim for perfection right away. Instead, set a starter milestone of $1,000 (₹50,000). This amount is enough to handle common emergencies like medical bills, urgent travel, or car repairs.

Once you’ve reached this point, you’ll feel an immediate sense of relief—and motivation to keep going.

3. Automate Your Savings

Consistency is key. Make saving effortless by setting up:

- Auto-transfers from checking to savings every payday.

- Systematic Investment Plans (SIPs) into liquid mutual funds if you’re in India.

When saving becomes automatic, you won’t miss the money—or be tempted to spend it.

4. Cut Costs and Redirect “Money Leaks”

Review your monthly spending to find areas where you can trim. Common culprits include:

- Streaming subscriptions you don’t use.

- Frequent eating out or ordering delivery.

- Unused gym memberships.

Redirect these savings straight into your emergency fund. Even small cuts, like ₹2,000 saved from eating out, can build up to ₹24,000 over a year.

5. Boost Your Income

Sometimes cutting costs isn’t enough—you also need to increase your inflows. Consider:

- Taking on side hustles like tutoring, content writing, or ridesharing.

- Using bonuses, freelance projects, or overtime pay.

- Selling unused items online (furniture, electronics, clothing).

Every extra rupee or dollar can accelerate your emergency fund growth.

6. Use Windfalls Wisely

Instead of splurging, direct unexpected income into your emergency savings. Examples include:

- Tax refunds (U.S.) or Diwali/Annual bonus (India).

- Monetary gifts from family events.

- Festival bonuses or company incentives.

Treat windfalls as an opportunity to leap ahead in your savings journey.

7. Review and Adjust Annually

Your expenses won’t stay the same forever. Each year, review your fund to account for:

- Inflation (cost of living rises annually).

- Lifestyle changes (marriage, kids, relocation).

- New responsibilities (loans, healthcare).

Recalculate your target and adjust contributions accordingly.

8. The 30-Day Starter Challenge (For Beginners)

If saving feels impossible, try this simple challenge:

- Save ₹500 ($6) per day for 30 days.

- By the end of the month, you’ll have ₹15,000 ($180)—enough to cover small emergencies.

This jump-starts your emergency fund and builds the savings habit quickly.

Building an emergency fund isn’t about big one-time deposits—it’s about steady progress. Start small, automate your savings, cut waste, boost income, and protect windfalls. With these steps, you’ll go from zero to a robust financial safety net faster than you think.

When (and When Not) to Use Your Emergency Fund

An emergency fund is your financial lifeline—but only if you use it the right way. Many people make the mistake of dipping into it for non-essentials, which defeats its purpose.

Valid Uses of an Emergency Fund

These situations justify tapping into your financial safety net:

- Job Loss: Cover essential expenses while you look for new work.

- Medical Emergencies: Hospital bills, urgent treatments, or sudden health costs.

- Essential Car Repairs: Only if it’s your primary transportation for work or family needs.

- Urgent Home Repairs: Fixing leaks, electrical faults, or other damage that threatens safety.

Not Valid Uses (What to Avoid)

Your emergency fund is not for lifestyle upgrades or predictable costs:

- Vacations or travel plans

- New gadgets or electronics

- Planned bills like annual premiums or school fees

- Investments or business opportunities

Using your emergency fund for these drains your protection and leaves you vulnerable when a real crisis strikes.

The Replenishment Rule

Once you dip into your emergency fund, make rebuilding it a priority. Aim to replace what you spent within 3–6 months.

- Redirect part of your paycheck until the fund is back to its original level.

- Channel windfalls (bonuses, tax refunds, gifts) directly into replenishment.

- Pause non-essential spending temporarily to speed up recovery.

Real-Life Examples: How an Emergency Fund Saved the Day

Numbers and rules are important, but nothing drives the point home like real-life stories. Here are a few scenarios where having an emergency fund made all the difference.

1. Job Loss → Covered Rent for 4 Months

When Ramesh, a mid-level manager in Bengaluru, was laid off during a corporate restructuring, he faced sudden unemployment. Thanks to his emergency fund, which covered four months of rent, groceries, and utilities, he didn’t have to borrow money or break his long-term investments. This buffer gave him the breathing room to find a new job that matched his skills—without rushing into the first offer.

2. Medical Bills → Avoided Credit Card Debt

In Chicago, Sarah needed emergency surgery after an accident. Her health insurance covered most of the costs, but she still had to pay $5,000 out of pocket. Instead of racking up high-interest credit card debt, Sarah tapped into her emergency savings. The fund not only saved her thousands in interest charges but also allowed her to focus on recovery instead of stressing over bills.

3. Freelancer Income Gap → Survived Without Loans

Aakash, a graphic designer working freelance, saw his client projects dry up for three months during a global slowdown. Without a steady paycheck, most people in his shoes would have taken a loan. Instead, Aakash used his emergency fund, which covered his rent, internet bills, and groceries until new contracts started rolling in. His financial cushion meant he didn’t have to lower his rates or accept unfavorable deals out of desperation.

4. Small Business Owner During Lockdown → Stayed Afloat

During the pandemic lockdowns, Priya’s café in Delhi had to close temporarily. With no customers and ongoing expenses like staff salaries and rent, many small businesses folded. But Priya had built up an emergency fund equal to six months of expenses. That safety net kept her business afloat until restrictions lifted, saving her years of effort from going to waste.

These stories show how an emergency fund acts as more than just money in the bank—it’s peace of mind, freedom of choice, and the ability to withstand life’s biggest shocks without falling into debt. Whether you’re an employee, freelancer, or entrepreneur, your emergency savings can be the difference between crisis and resilience.

Common Mistakes to Avoid With Your Emergency Fund

Building an emergency fund is a smart move—but only if you manage it wisely. Many people fall into traps that weaken their safety net. Here are the most common mistakes to avoid, along with better strategies.

1. Relying on Credit Cards as a Backup

Some people think, “I don’t need an emergency fund—my credit card is my safety net.” But this is risky.

- Why it’s a mistake: Credit cards carry high interest (often 20%+ annually). Borrowing during a crisis only digs you into deeper debt.

- Better approach: Use credit cards as a temporary bridge only if absolutely necessary, and focus on replenishing your emergency fund so you’re not dependent on debt.

2. Keeping 100% of Funds in Cash

It may feel safe to keep emergency money under the mattress or in a locker, but it’s not practical.

- Why it’s a mistake: Cash earns nothing, and with inflation, it actually loses value over time. Plus, it’s vulnerable to theft or damage.

- Better approach: Keep a small amount (enough for a few days’ expenses) in physical cash for quick access, but store the rest in safe, liquid accounts like high-yield savings or liquid mutual funds.

3. Over-Investing Your Emergency Fund

It’s tempting to try to “grow” your emergency savings by putting them into stocks, crypto, or real estate.

- Why it’s a mistake: Investments are volatile and may lose value right when you need the money most.

- Better approach: Remember, your emergency fund is about stability, not growth. Keep it safe, even if returns are modest.

4. Ignoring Inflation

Prices rise every year, and your emergency fund needs to keep up.

- Why it’s a mistake: A fund built five years ago may not cover today’s higher rent, food, or medical bills.

- Better approach: Review your emergency savings annually. Adjust for inflation and lifestyle changes to make sure your fund remains adequate.

5. Not Replenishing After Use

Dipping into your emergency fund is fine—that’s what it’s for—but failing to refill it is a serious misstep.

- Why it’s a mistake: Once used, your safety net shrinks, leaving you vulnerable to the next crisis.

- Better approach: Follow the 3–6 month replenishment rule. Make rebuilding your fund a top financial priority, even if it means cutting back temporarily.

Your emergency fund is like a parachute—you only get one chance to use it properly. Avoid these mistakes, keep your money liquid and safe, and commit to regular reviews so your safety net stays strong when you need it most.

Myths Debunked: The Truth About Emergency Funds

Many people delay building an emergency fund because of common misconceptions. Let’s break down the biggest myths and set the record straight.

Myth 1: “Credit Cards = Emergency Fund.”

Some believe that a credit card can replace an emergency savings account.

- Why it’s wrong: Credit cards are debt, not savings. Using them in a crisis means piling high-interest payments on top of your problem.

- The truth: A credit card can provide temporary help, but only a cash-based emergency fund offers true financial safety without long-term consequences.

Myth 2: “Insurance Replaces the Need for an Emergency Fund.”

Health, auto, or home insurance can help—but they don’t cover everything.

- Why it’s wrong: Insurance often comes with deductibles, exclusions, and waiting periods. It won’t cover lost income or all out-of-pocket expenses.

- The truth: Insurance and an emergency fund work together. One covers specific risks, the other provides flexible protection for the unexpected.

Myth 3: “Six Months of Savings Is Always Enough.”

The classic advice is to save 3–6 months of expenses. But is it always sufficient?

- Why it’s wrong: If you’re self-employed, a freelancer, or approaching retirement, six months may not be enough to cover income gaps.

- The truth: Your fund size should be personalized. For stable jobs, 3–6 months is fine. For variable income or high responsibility, aim for 9–18 months.

Myth 4: “Emergency Funds Should Earn High Returns.”

Some people treat their emergency fund like an investment.

- Why it’s wrong: High returns usually come with high risks or limited access. That defeats the purpose of having cash available quickly.

- The truth: Your emergency fund is about liquidity and safety, not profit. Modest returns from a savings account or liquid fund are more than enough.

Myth 5: “Only Rich People Need Emergency Funds.”

A dangerous myth is that only wealthy people can afford to have a financial cushion.

- Why it’s wrong: Emergencies don’t discriminate—medical bills, layoffs, and repairs can hit anyone, regardless of income.

- The truth: In fact, lower- and middle-income households benefit the most from having an emergency fund, since they have fewer financial fallbacks. Even a small starter fund of $500 (₹40,000) can make a huge difference.

Your emergency fund isn’t a luxury—it’s a necessity. By separating myths from facts, you’ll see why building and protecting your fund is one of the smartest financial moves you can make in 2025 and beyond.

Advanced Strategies for 2025: Smarter Ways to Manage Your Emergency Fund

Building an emergency fund is the first step to financial security—but in 2025, the real challenge is managing it wisely. With rising inflation, unpredictable job markets, and the growing trend of freelancing and side hustles, simply following old rules may not be enough. Once you’ve secured the basics, here are advanced strategies to optimize your emergency fund for today’s economy.

1. The Laddering Approach (3-Account Strategy)

Instead of keeping all your money in one place, spread it across three different accounts to balance safety, liquidity, and returns:

- Checking Account (Immediate Access):

- Keep 1–2 weeks of essential expenses here.

- Purpose: Handle sudden bills like car repairs, urgent travel, or a medical co-pay.

- Pro: Instant access through ATM/debit card.

- Con: Very low or no interest.

- Keep 1–2 weeks of essential expenses here.

- High-Yield Savings Account (Core Fund):

- Store 2–4 months of expenses in a U.S. high-yield savings account (4–5% APY) or Indian auto-sweep savings account.

- Pro: FDIC/insurance protection, higher interest than standard accounts.

- Con: Rates fluctuate with central bank policies.

- Store 2–4 months of expenses in a U.S. high-yield savings account (4–5% APY) or Indian auto-sweep savings account.

- Liquid Mutual Funds / Money Market Funds (Backup Layer):

- Allocate the rest of your fund here.

- Pro: Slightly better returns, redeemable in 24 hours.

- Con: Not 100% risk-free—NAV can fluctuate slightly.

- Allocate the rest of your fund here.

Why this works: The laddering approach ensures you have cash at multiple levels—some instantly, some earning interest, and some growing modestly—while always remaining accessible.

2. Combining Emergency Fund With Insurance

One of the smartest ways to protect yourself financially is by using insurance and emergency savings together.

- Health Insurance: Covers hospital stays, but you’ll still need cash for deductibles, medicines, and non-covered expenses.

- Disability/Income Protection: Useful for freelancers or those in unstable industries. If income stops, your insurance covers part of it while your emergency fund fills the gap.

- Home & Auto Insurance: These cover accidents or disasters, but claims can take weeks to process. An emergency fund bridges that waiting period.

View insurance as your shield against big risks and your emergency fund as your backup engine for everything else. Together, they make your safety net nearly bulletproof.

3. Adjusting for Inflation Annually

Inflation silently eats away at savings. A fund that covered 6 months of living expenses in 2020 may now cover only 4–5 months in 2025.

- Action Step: Review your expenses once a year. If your monthly budget has grown from ₹50,000 to ₹55,000 due to inflation, update your emergency fund goal accordingly.

- Real-Life Example: Suppose you built a $12,000 fund in 2020 to cover 6 months. With 20% inflation over five years, you now need about $14,400 to maintain the same safety net.

By recalculating annually, you ensure your emergency fund remains relevant and realistic.

4. Reducing Fund Size If You Have Passive Income

Not everyone needs the same size emergency cushion. If you have reliable passive income streams, you can reduce the size of your emergency fund without sacrificing security.

- Example 1 (Rental Income):

Monthly expenses = $2,000. Rental income covers $800.

Emergency fund needs = $1,200 × 6 months = $7,200 (instead of $12,000). - Example 2 (Side Hustle):

If your side hustle consistently earns ₹20,000 per month, you can adjust your fund downward since you already have a backup cash flow.

Reassess your passive income annually. If it’s steady and reliable, trim your emergency fund and redirect extra cash into investments or debt repayment.

5. The Hybrid Approach: Partial Cash, Partial Growth

Some advanced savers prefer splitting their fund between safe liquid options and slightly higher-yield but safe investments.

- 70% in savings, FDs, or liquid mutual funds.

- 30% in short-term bonds or ultra-safe instruments.

This way, most of your fund remains liquid and accessible, while a portion combats inflation. But remember: never risk the majority of your fund.

6. Geo-Specific Adjustments

Where you live also affects how much you need and where you keep it.

- U.S.: High-yield savings + money market accounts offer the best mix.

- India: Liquid mutual funds + fixed deposits (with easy withdrawal) are practical.

- Global Expats: A mix of local currency + home-country accounts avoids exchange rate shocks.

7. Mental Segmentation (Labeling Funds)

Behavioral finance research shows people save better when money is labeled. Instead of a single emergency account, create sub-accounts:

- “Medical Emergencies”

- “Job Loss Buffer”

- “Unexpected Repairs”

Even if all accounts draw from the same pool, labeling them can make you less likely to dip into the fund for non-emergencies.

In 2025, an emergency fund isn’t just about having money in the bank—it’s about structuring it smartly. Use laddering to balance access and growth, pair it with insurance for complete coverage, adjust for inflation regularly, and customize it based on your income streams. By applying these advanced strategies, you’ll turn a simple savings account into a powerful financial shield that adapts with your life.

Tools & Resources to Build and Manage Your Emergency Fund

Having the right tools and resources can make saving for an emergency fund easier, faster, and even motivating. Here are some practical options to help you plan, track, and grow your safety net.

1. Emergency Fund Calculator

Use this Calculator to check how much you need to build your Emergency Fund.

💰 Emergency Fund Calculator

2. Printable Savings Tracker (PDF or Spreadsheet)

Tracking your progress keeps you motivated. Create a simple savings tracker where you:

- Write down your emergency fund goal.

- Break it into smaller milestones (₹10,000 / $500 each).

- Check off each milestone as you reach it.

You can use a printable PDF tracker on your fridge or a Google Sheet/Excel template that updates automatically. The visual progress helps you stay consistent.

3. Suggested Banks and Fund Categories

Without endorsing specific institutions, here are safe categories where you can park your emergency savings:

- For U.S. Residents:

- High-yield online savings accounts

- Money market accounts (FDIC-insured)

- Short-term Treasury-backed funds

- High-yield online savings accounts

- For Indian Residents:

- Fixed deposits with flexible withdrawal

- Liquid mutual funds (redeemable in 24 hours)

- Sweep-in savings accounts with auto-transfers

- Fixed deposits with flexible withdrawal

Stick to low-risk, high-liquidity options. The goal is accessibility, not maximum returns.

4. Related Budgeting & Money Management Resources

An emergency fund is just one piece of the financial puzzle. Pair it with smart budgeting and planning to stay fully prepared.

- 50/30/20 Budgeting Rule (50% needs, 30% wants, 20% savings)

- Zero-Based Budgeting (assign every rupee/dollar a role)

- Envelope Method (Digital or Cash) for controlling variable expenses

- Debt Snowball & Avalanche Methods for clearing high-interest loans

The right tools—a calculator, tracker, safe accounts, and budgeting systems—make your emergency fund journey simpler and more effective. With clear targets and consistent tracking, you’ll stay motivated and confident as your safety net grows.

Conclusion: An emergency fund provides financial security and peace of mind.

At the end of the day, an emergency fund is not just about numbers on a bank statement—it’s about building peace of mind.

- It shields you from sleepless nights when an unexpected bill arrives.

- It prevents you from falling into the debt trap during crises.

- And most importantly, it gives you the freedom to make better choices without fear dictating your decisions.

Peace of Mind Matters More Than Returns

Some people obsess over where to keep their emergency fund and how much interest it earns. But here’s the truth: safety and accessibility are more important than returns. Even if your fund grows slowly, the security it provides is priceless.

Start Small, Grow Steadily, Review Regularly

- Begin with a starter goal—₹50,000 ($1,000) is enough to handle small shocks.

- Build it step by step until you reach 3–6 months of expenses (or more if your situation requires).

- Review it every year to adjust for inflation and life changes like marriage, kids, or relocation.

Remember, consistency beats perfection. Every deposit, no matter how small, brings you closer to financial resilience.

Your Emergency Fund = Confidence, Freedom, Security

Your emergency fund isn’t just money sitting in an account. It’s:

- Confidence to face the unknown without fear.

- Freedom to say no to toxic jobs or bad deals because you have a buffer.

- Security for your family and loved ones when life throws a curveball.

Start today. Even if it’s just a few hundred rupees or dollars, the best time to begin your emergency fund is now.

Because financial freedom isn’t built on luck—it’s built on preparation. And your emergency fund is the first, most powerful step.

FAQs About Emergency Funds

1. How much emergency fund is enough in India and the U.S.?

India: A good starting point is ₹50,000–₹1,00,000, but ideally, you should aim for 6–9 months of expenses due to unpredictable healthcare costs and limited unemployment support.

U.S.: Experts recommend 3–6 months of essential expenses for salaried employees, while freelancers or self-employed individuals may need 9–12 months because of higher income volatility.

Rule of thumb: Calculate your monthly expenses (rent, food, utilities, transport, insurance) and multiply by at least 3–6.

2. Where is the best place to keep an emergency fund?

The best place is where your money is:

Safe: Protected from market risks.

Liquid: Accessible within 24–48 hours.

Accessible: No penalties or restrictions.

Options include high-yield savings accounts (U.S.), liquid mutual funds and fixed deposits (India), or money market funds.

Avoid stocks, crypto, or retirement accounts—too risky or inaccessible.

3. Should I build an emergency fund or pay debt first?

Both are important, but the strategy depends on your situation:

High-interest debt (like credit cards): Pay it down aggressively while keeping at least a small starter emergency fund ($500–$1,000 / ₹25,000–₹50,000).

Low-interest debt (like student loans, mortgages): Focus first on building a 3–6 month emergency fund, then accelerate debt repayment.

Think of it this way: Your emergency fund prevents you from taking on more debt when a crisis hits.

4. Can I invest my emergency fund in stocks or crypto?

No. Stocks and crypto are too volatile and unpredictable. An emergency fund must be stable, liquid, and reliable.

If you invest your emergency fund and the market crashes, you may lose access to the money just when you need it most.

Instead, stick to savings accounts, liquid mutual funds, or money market funds.

Keep investing for long-term wealth—but keep your emergency fund safe.

5. Is ₹1 lakh or $2,000 enough as a starter emergency fund?

Yes, for many people this is a solid starter milestone.

In India, ₹1 lakh can cover small emergencies like medical expenses, car repairs, or 1–2 months of rent in many cities.

In the U.S., $2,000 provides a cushion for surprise medical bills, travel, or essential repairs.

Over time, though, you should expand your emergency fund to cover 3–6 months of expenses for true financial security.

6. Do freelancers need bigger emergency funds?

Absolutely. Freelancers, gig workers, and self-employed professionals face irregular income and sometimes long payment delays.

Minimum target: 9–12 months of expenses.

Extra tip: Split your emergency fund into two parts—personal expenses and business expenses—to keep both worlds protected.

Think of it as a shield against slow-paying clients, dry spells, or project cancellations.

7. How often should I review my emergency fund?

At least once a year.

Check for inflation: Are your expenses higher now than last year?

Adjust for lifestyle changes: Marriage, kids, new city, or higher rent = bigger fund.

Replenish if used: Always rebuild within 3–6 months after dipping into it.

Review your emergency fund during your annual financial check-up—right alongside taxes, investments, and insurance.