![Best Credit Cards With No Annual Fee in the U.S. [year] 1 Person comparing credit cards with no annual fee options](https://www.smartsourav.com/wp-content/uploads/2025/11/Person-comparing-credit-cards-with-no-annual-fee-options.jpeg)

Best Credit Cards With No Annual Fee in the U.S. 2025

Why Choose a Credit Card With No Annual Fee?

Before diving into specific card recommendations, it’s important to understand the advantages of no annual fee credit cards. These cards have become increasingly popular in 2025 as consumers seek to maximize value while minimizing costs.

Advantages of No Annual Fee Cards

- No yearly cost to maintain the card

- Great for occasional use or as backup cards

- Easier to keep long-term, which helps build credit history

- Many now offer competitive rewards programs

- Excellent intro APR offers on purchases and balance transfers

- Sign-up bonuses with reasonable spending requirements

Potential Drawbacks

- May offer fewer premium benefits than annual fee cards

- Typically lower rewards rates on some spending categories

- Limited travel perks and protections

- May have higher foreign transaction fees

- Sign-up bonuses generally smaller than premium cards

For most everyday consumers, the benefits of no annual fee cards far outweigh the drawbacks, especially if you’re strategic about which card you choose based on your spending habits and financial goals.

Top Cash Back Credit Cards With No Annual Fee

Cash back rewards remain the most popular and straightforward benefit for many cardholders. These no annual fee options offer excellent returns on everyday spending in 2025.

Chase Freedom

Key Features:

- Rewards Rate: 5% cash back on rotating quarterly categories (up to $1,500 in combined purchases per quarter); 1% unlimited cash back on all other purchases

- Sign-up Bonus: $150 bonus after spending $500 on purchases within the first 3 months from account opening

- Intro APR: 0% intro APR on purchases and balance transfers for 15 months

- Regular APR: 13.99% – 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Foreign Transaction Fee: 3%

Pros

- High 5% cash back in rotating categories

- Generous sign-up bonus with low spending requirement

- Long 0% intro APR period

- No annual fee

Cons

- Need to activate categories each quarter

- 3% foreign transaction fee

- Requires good to excellent credit

Discover it® Cash Back

Key Features:

- Rewards Rate: 5% cash back on rotating quarterly categories (up to $1,500 in purchases each quarter); 1% unlimited cash back on all other purchases

- Sign-up Bonus: Cashback Match™ – Discover automatically matches all cash back earned at the end of your first year

- Intro APR: 0% intro APR on purchases and balance transfers for 14 months

- Regular APR: 11.99% – 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Foreign Transaction Fee: None

Pros

- First-year cash back match effectively doubles rewards

- No foreign transaction fees

- Free FICO® Score on monthly statements

- No penalty APR for late payments

Cons

- Need to activate categories each quarter

- Not as widely accepted internationally as Visa/Mastercard

- Requires good to excellent credit

Citi® Double Cash Card

Key Features:

- Rewards Rate: 1% cash back on purchases plus 1% cash back as you pay for those purchases

- Sign-up Bonus: None (as of 2025)

- Intro APR: 0% intro APR on balance transfers for 18 months

- Regular APR: 13.99% – 23.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Foreign Transaction Fee: 3%

Pros

- Effective 2% cash back on all purchases

- No categories to track or activate

- Long intro APR period for balance transfers

- No annual fee

Cons

- No sign-up bonus

- 3% foreign transaction fee

- No 0% intro APR on purchases

Best Balance Transfer Credit Cards With No Annual Fee

If you’re carrying high-interest credit card debt, these no annual fee balance transfer cards can help you save money and pay down your balance faster in 2025.

Chase Slate®

Key Features:

- Intro Balance Transfer Offer: $0 intro balance transfer fee for transfers made within the first 60 days of account opening

- Intro APR: 0% intro APR on purchases and balance transfers for 15 months

- Regular APR: 12.99% – 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Rewards: None

Pros

- No balance transfer fee for first 60 days

- Long 0% intro APR period

- Free monthly FICO® Score

- No penalty APR for late payments

Cons

- No rewards program

- 3% foreign transaction fee

- Requires good to excellent credit

Citi Simplicity® Card

Key Features:

- Intro Balance Transfer Offer: 0% intro APR on balance transfers for 21 months

- Intro Purchase APR: 0% intro APR on purchases for 12 months

- Balance Transfer Fee: 3% of each transfer (minimum $5)

- Regular APR: 13.99% – 23.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Rewards: None

Pros

- Industry-leading 21-month 0% intro APR on balance transfers

- No late fees ever

- No penalty APR for late payments

- No annual fee

Cons

- No rewards program

- 3% balance transfer fee

- 3% foreign transaction fee

Best Travel Rewards Credit Cards With No Annual Fee

Travelers can earn valuable rewards without paying an annual fee with these cards designed for those who enjoy domestic and international travel.

Capital One® VentureOne® Rewards Credit Card

Key Features:

- Rewards Rate: 1.25 miles per dollar on every purchase

- Sign-up Bonus: 20,000 bonus miles after spending $1,000 on purchases within the first 3 months

- Intro APR: 0% intro APR on purchases for 12 months

- Regular APR: 12.9% – 22.9% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Foreign Transaction Fee: None

Pros

- No foreign transaction fees

- Flexible redemption options with no blackout dates

- Miles don’t expire for the life of the account

- Decent sign-up bonus for a no-fee card

Cons

- Lower base earning rate than some competitors

- Limited travel protections compared to annual-fee cards

- No bonus categories for additional miles

Bank of America® Travel Rewards Credit Card

Key Features:

- Rewards Rate: 1.5 points per dollar on all purchases

- Sign-up Bonus: 20,000 online bonus points after spending $1,000 in purchases within the first 90 days

- Intro APR: 0% intro APR on purchases for 12 billing cycles

- Regular APR: 14.99% – 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Good to Excellent (670-850)

- Foreign Transaction Fee: None

Pros

- Higher base earning rate than many travel cards

- 10% points bonus for Bank of America checking/savings customers

- No foreign transaction fees

- Points can be redeemed for statement credits against travel purchases

Cons

- Limited travel protections

- No transfer partners for points

- Best value requires Bank of America relationship

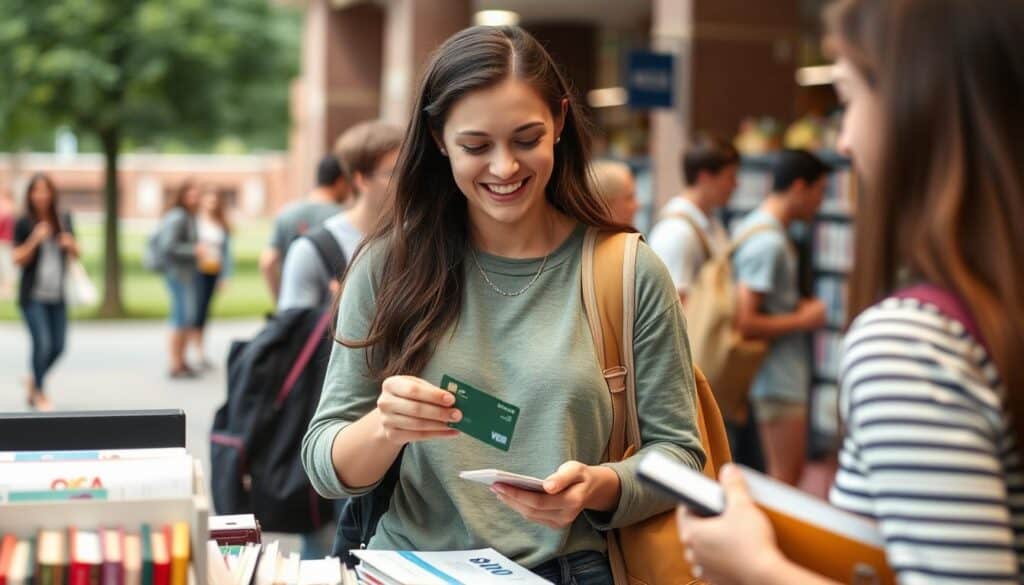

Best Student Credit Cards With No Annual Fee

College students can build credit responsibly with these no annual fee cards designed specifically for their needs and spending habits.

Discover it® Student Cash Back

Key Features:

- Rewards Rate: 5% cash back on rotating quarterly categories (up to $1,500 in purchases each quarter); 1% unlimited cash back on all other purchases

- Sign-up Bonus: Cashback Match™ – Discover automatically matches all cash back earned at the end of your first year

- Student Benefits: $20 statement credit each school year your GPA is 3.0 or higher for up to 5 years

- Intro APR: 0% intro APR on purchases for 6 months

- Regular APR: 13.99% – 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Fair to Good (630-689)

- Foreign Transaction Fee: None

Pros

- First-year cash back match

- Good grades reward program

- Free FICO® Score on monthly statements

- No late fee on first late payment

Cons

- Need to activate categories each quarter

- Not as widely accepted internationally as Visa/Mastercard

- Shorter intro APR period than non-student cards

Capital One® Journey® Student Credit Card

Key Features:

- Rewards Rate: 1% cash back on all purchases; 1.25% cash back when you pay on time

- Sign-up Bonus: None

- Credit Building: Access to a higher credit line after making first 5 monthly payments on time

- Intro APR: None

- Regular APR: 19.8% Variable APR

- Annual Fee: $0

- Credit Score Required: Average to Fair (580-669)

- Foreign Transaction Fee: None

Pros

- Designed for students with limited credit history

- Rewards on-time payments with higher cash back

- No foreign transaction fees

- Access to CreditWise® credit monitoring

Cons

- Higher APR than other student cards

- No intro APR offer

- No sign-up bonus

Best Secured Credit Cards With No Annual Fee

If you’re looking to build or rebuild your credit, these secured cards offer a path to better credit without charging an annual fee.

Discover it® Secured Credit Card

Key Features:

- Security Deposit: $200 minimum (refundable)

- Rewards Rate: 2% cash back at gas stations and restaurants (up to $1,000 in combined purchases each quarter); 1% unlimited cash back on all other purchases

- Sign-up Bonus: Cashback Match™ – Discover automatically matches all cash back earned at the end of your first year

- Credit Building: Monthly FICO® Score for free, automatic reviews starting at 8 months to see if you can transition to an unsecured card

- Regular APR: 22.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Poor to Fair (300-629)

- Foreign Transaction Fee: None

Pros

- Earns cash back rewards (rare for secured cards)

- First-year cash back match

- Path to upgrade to unsecured card

- No annual fee or hidden fees

Cons

- Requires security deposit

- Higher APR than some alternatives

- Not as widely accepted internationally as Visa/Mastercard

Capital One® Secured Mastercard®

Key Features:

- Security Deposit: $49, $99, or $200 based on creditworthiness (refundable)

- Credit Line: Initial $200 credit line with opportunity to increase with responsible use

- Credit Building: Access to a higher credit line after making first 5 monthly payments on time

- Rewards: None

- Regular APR: 24.99% Variable APR

- Annual Fee: $0

- Credit Score Required: Poor to Fair (300-629)

- Foreign Transaction Fee: None

Pros

- Possibility of lower security deposit ($49 or $99)

- Credit line increase consideration after 5 on-time payments

- No foreign transaction fees

- Access to CreditWise® credit monitoring

Cons

- No rewards program

- Higher APR than some alternatives

- Initial credit limit may be low

No Annual Fee Credit Cards Comparison Table

Use this comprehensive comparison table to quickly evaluate the key features of our top recommended no annual fee credit cards for 2025.

| Credit Card | Rewards Rate | Sign-up Bonus | Intro APR | Regular APR | Credit Score Needed | Best For |

| Chase Freedom | 5% rotating categories; 1% on all else | $150 after $500 spend | 0% for 15 months | 13.99% – 22.99% | Good to Excellent | Rotating category spenders |

| Discover it Cash Back | 5% rotating categories; 1% on all else | Cashback Match (first year) | 0% for 14 months | 11.99% – 22.99% | Good to Excellent | First-year rewards maximizers |

| Citi Double Cash | 1% + 1% (effectively 2%) | None | 0% for 18 months (BT only) | 13.99% – 23.99% | Good to Excellent | Flat-rate cash back |

| Chase Slate | None | None | 0% for 15 months | 12.99% – 22.99% | Good to Excellent | No-fee balance transfers |

| Capital One VentureOne | 1.25 miles per $1 | 20,000 miles after $1,000 spend | 0% for 12 months (purchases) | 12.9% – 22.9% | Good to Excellent | Flexible travel rewards |

| Discover it Secured | 2% at gas/restaurants; 1% on all else | Cashback Match (first year) | None | 22.99% | Poor to Fair | Credit building with rewards |

How to Choose the Right No Annual Fee Credit Card

With so many no annual fee options available in 2025, selecting the right card depends on your specific financial needs and spending habits. Here’s a practical framework to help you make the best choice:

For Everyday Spenders

- Look for flat-rate cash back cards (1.5%-2%)

- Consider cards with bonus categories that match your spending

- Prioritize ease of redemption

- Check for useful shopping protections

- Best picks: Citi Double Cash, Chase Freedom

For Debt Consolidators

- Prioritize length of 0% intro APR period

- Check balance transfer fees (3%-5% typical)

- Look for $0 balance transfer fee promotions

- Consider ongoing APR after promo period

- Best picks: Chase Slate, Citi Simplicity

For Travelers

- Ensure no foreign transaction fees

- Look for travel-specific rewards

- Check for travel protections and insurance

- Consider airline/hotel partnerships

- Best picks: Capital One VentureOne, BofA Travel Rewards

Key Factors to Consider:

- Your Credit Score: Be realistic about approval odds based on your current credit profile

- Spending Patterns: Analyze where you spend most to maximize category bonuses

- Redemption Preferences: Consider how easily you can use the rewards you earn

- Existing Banking Relationships: Some cards offer bonuses for existing customers

- Special Needs: Balance transfers, building credit, or specific rewards

Application Process and Eligibility Requirements

Understanding the application process and eligibility requirements can help increase your chances of approval for the no annual fee credit card that best fits your needs.

Typical Application Requirements:

- Personal Information: Name, address, phone number, email, SSN

- Financial Information: Annual income, employment status, monthly housing payment

- Identity Verification: May require uploading identification documents

- Credit Check: Most issuers will perform a hard inquiry on your credit report

Tips to Improve Approval Odds:

- Check your credit report before applying to identify and address any errors

- Use pre-qualification tools when available to gauge approval chances without a hard credit pull

- Apply for cards that match your credit profile to avoid unnecessary rejections

- Space out applications by at least 3-6 months to minimize credit score impact

- Include all household income you have reasonable access to (as permitted by law)

- Provide accurate information to avoid delays or denials

Pro Tip: If you’re denied for a credit card, you have the right to request the specific reasons for denial. This information can help you address issues before applying again.

Tips for Maximizing Rewards Without Paying Fees

No annual fee credit cards can provide substantial value when used strategically. Here are practical tips to maximize your rewards without paying fees.

Strategic Card Usage:

- Pair complementary cards to maximize category bonuses (e.g., Chase Freedom for 5% categories and Citi Double Cash for everything else)

- Set calendar reminders to activate quarterly bonus categories

- Use category spending trackers to ensure you don’t exceed bonus limits

- Set up automatic payments to avoid late fees and interest charges

- Use shopping portals offered by your card issuer to earn additional rewards

Redemption Strategies:

- Understand redemption values across different options (statement credits, gift cards, travel)

- Watch for redemption promotions that can boost the value of your points

- Avoid low-value redemption options like merchandise or certain gift cards

- Consider pooling points with compatible cards from the same issuer

- Redeem regularly to avoid potential devaluation or expiration

“The best rewards strategy is one you can consistently execute. Choose cards that align with your natural spending patterns rather than changing your habits to chase rewards.”

Credit Building Strategies Using No Annual Fee Cards

No annual fee credit cards are excellent tools for building or rebuilding credit. Here’s how to use them effectively to improve your credit profile.

Fundamental Credit Building Practices:

- Pay on time, every time – Payment history is the most important credit score factor

- Keep utilization low – Aim to use less than 30% of your available credit

- Don’t close old accounts – Length of credit history matters

- Monitor your credit report – Check for errors and track progress

- Limit new applications – Too many inquiries can hurt your score

Credit Building Card Progression:

Starting Point (Poor/No Credit):

- Secured cards (Discover it Secured, Capital One Secured)

- Student cards (if eligible)

- Store cards (easier approval but higher APRs)

Next Step (Fair Credit):

- Entry-level rewards cards (Capital One QuicksilverOne)

- Upgrade paths from secured cards

- Credit union offerings

Building Further (Good Credit):

- Cash back cards (Chase Freedom, Citi Double Cash)

- Low-interest options

- Co-branded retail cards with better terms

Established Credit (Excellent):

- Premium no-fee options

- Multiple card strategy for maximum rewards

- Consider if premium annual fee cards now make sense

Credit Building Timeline: With responsible use, you can typically move from a secured card to better options in 12-18 months. Most people can build from poor credit to good credit in about 2 years of consistent positive behavior.

Frequently Asked Questions About No Annual Fee Credit Cards

Are credit cards with no annual fee really free?

While no annual fee cards don’t charge a yearly fee for card membership, they may have other potential costs including interest charges, balance transfer fees, foreign transaction fees, late payment fees, and cash advance fees. To truly keep your card “free,” pay your balance in full each month to avoid interest charges and be aware of other potential fees.

Do no annual fee cards offer worse rewards than cards with fees?

Generally, premium cards with annual fees offer higher rewards rates and more valuable perks. However, many no annual fee cards now offer competitive rewards that can provide excellent value, especially for moderate spenders. The key is determining whether you’ll use the premium benefits enough to offset an annual fee. For many consumers, no annual fee cards provide better overall value.

What credit score do I need for a no annual fee credit card?

Credit score requirements vary by card. Some secured and student no annual fee cards accept applicants with fair or limited credit (FICO scores around 580-669). Most rewards-focused no annual fee cards require good to excellent credit (FICO scores of 670+). Check the specific card requirements before applying, and consider using pre-qualification tools when available.

Can I get a no annual fee card with bad credit?

Yes, there are options for those with poor credit (FICO scores below 580). Secured credit cards like the Discover it Secured and Capital One Secured Mastercard have no annual fee and are designed for credit building. These cards require a refundable security deposit that typically becomes your credit limit. With responsible use, many secured card users can graduate to unsecured options in 12-18 months.

Is it better to have multiple no annual fee cards or one premium card?

This depends on your spending habits and preferences. Multiple no annual fee cards can allow you to maximize category bonuses across different spending areas without paying annual fees. However, juggling multiple cards requires more effort and organization. A premium card might be simpler and offer valuable benefits like airport lounge access or travel credits that matter to you. Many experienced credit card users employ a hybrid approach with both types.

Will closing a no annual fee card hurt my credit score?

Closing any credit card can potentially impact your credit score in two ways: by reducing your total available credit (which can increase your credit utilization ratio) and by eventually affecting your average age of accounts. Since no annual fee cards don’t cost anything to maintain, it’s generally better to keep them open, especially older accounts. If you must close a card, consider closing newer accounts first.

Personalized Recommendations by User Profile

Based on different financial needs and spending habits, here are our top recommendations for no annual fee credit cards in 2025.

For Students

Top Pick: Discover it Student Cash Back

Perfect for students building credit while earning rewards on everyday purchases. The good grades reward and first-year cash back match make this an exceptional value.

Runner-up: Capital One Journey Student

For Everyday Spenders

Top Pick: Citi Double Cash Card

Ideal for those who want simple, consistent rewards without tracking categories. The effective 2% cash back on everything is among the best flat-rate returns available.

Runner-up: Chase Freedom

For Travelers

Top Pick: Capital One VentureOne

Best for occasional travelers who want flexible rewards without foreign transaction fees. The sign-up bonus and 1.25 miles per dollar provide solid value.

Runner-up: Bank of America Travel Rewards

For Credit Builders

Top Pick: Discover it Secured

The rare secured card that offers rewards and a clear upgrade path. Perfect for those rebuilding credit who don’t want to sacrifice earning potential.

Runner-up: Capital One Secured Mastercard

For Balance Transfers

Top Pick: Chase Slate

The $0 intro balance transfer fee makes this the most cost-effective option for consolidating debt, especially for those who can pay off the balance during the intro period.

Runner-up: Citi Simplicity

For Maximizing First Year Value

Top Pick: Discover it Cash Back

The cash back match effectively doubles all rewards in the first year, making this an exceptional choice for those looking to maximize initial return.

Runner-up: Chase Freedom

Conclusion: Finding Your Ideal No Annual Fee Credit Card

In 2025, credit cards with no annual fee offer more value than ever before. From generous cash back rewards to lengthy 0% APR periods and valuable sign-up bonuses, these cards provide substantial benefits without the yearly cost of premium cards.

When selecting your ideal no annual fee card, focus on matching the card’s features to your specific spending habits and financial goals. Consider factors like rewards structure, intro APR offers, foreign transaction fees, and credit building features to find the perfect fit.

Remember that responsible credit card use—paying on time and in full whenever possible—is the key to maximizing value while avoiding interest and fees. With the right strategy, no annual fee credit cards can be powerful tools for building credit, earning rewards, and achieving your financial objectives.

Disclaimer: Credit card terms, interest rates, and rewards programs are subject to change. The information presented in this article is accurate as of publication in 2025. Always review the current terms and conditions before applying for any credit card.

Ready to apply for a no annual fee credit card?

Compare our top recommendations and find the perfect card for your needs.