How to Invest in Stock Market in India as a Beginner

If you are searching for how to invest in stock market, chances are you are a complete beginner. You may have heard stories of people making money from shares, mutual funds, or SIPs, but at the same time you may also feel scared about losing money. This confusion is very normal.

The stock market is not gambling, and it is not only for experts or rich people. When understood properly, it is simply a system where ordinary people can become part-owners of good businesses and grow their money over time. In this guide, I will explain everything step by step in very simple language, exactly the way I explain to first-time students.

By the end of this article, you will clearly know what the stock market is, how to start investing in it, what to buy as a beginner, and what mistakes you must avoid.

Table of Contents

What Is the Stock Market? (Simple Explanation)

The stock market is a place where shares of companies are bought and sold. A share represents a small ownership in a company. When you buy a share, you become a part-owner of that business.

In India, most stock market transactions happen through two main exchanges: the Bombay Stock Exchange (BSE) and the National Stock Exchange (NSE). These exchanges provide a platform where buyers and sellers meet digitally and trade shares at transparent prices.

Companies come to the stock market mainly to raise money for growth. Investors participate because they want their money to grow along with the company’s success.

How the Stock Market Actually Works

When a company first offers its shares to the public, it does so through an IPO (Initial Public Offering). This is called the primary market. Once shares are listed, investors trade them among themselves every day. This happens in the secondary market, which is what most people refer to when they talk about the stock market.

Stock prices move because of demand and supply. When more people want to buy a stock than sell it, the price goes up. When more people want to sell than buy, the price falls. Behind this demand and supply are factors like company performance, profits, economic conditions, interest rates, global markets, and investor emotions.

To track the overall market direction, we use market indices. In India, Sensex and Nifty 50 are the most popular indices. They represent the performance of top large companies and give a quick idea of whether the market is rising or falling.

Investing vs Trading: Understand This First

One of the biggest confusions for beginners is the difference between investing and trading. Investing means buying quality assets and holding them for the long term, usually for years. The goal is wealth creation through business growth and compounding.

Trading, on the other hand, focuses on short-term price movements. It requires daily monitoring, technical skills, emotional control, and experience. For most beginners, trading creates stress and losses rather than wealth.

If you are starting your journey and searching for how to invest in stock market, your focus should be on investing, not trading.

Why Should Beginners Invest in the Stock Market?

Keeping money only in a savings account is not enough because inflation slowly reduces its value. The stock market, when approached sensibly, helps your money grow faster than inflation over the long term.

Investing also allows you to participate in the growth of India’s economy. As companies grow revenues and profits, shareholders benefit through rising stock prices and dividends.

You do not need a large amount of money to start. Today, even ₹500 or ₹1,000 is enough to begin investing through mutual funds or ETFs.

If you are confused about how much to invest or what your money can grow into over time, simple planning makes a big difference.

You can use the SIP and investment calculators on SmartSourav.com to estimate future returns, understand the power of compounding, and set realistic investment goals before putting your hard-earned money into the market.

Things You Must Set Before You Start Investing

Before opening any account or buying any stock, you need clarity on three things: your goal, your time horizon, and your risk tolerance.

Your goal could be long-term wealth creation, retirement, children’s education, or financial independence. Time horizon means how long you can stay invested without needing the money. Risk tolerance refers to how much price fluctuation you can mentally handle without panic.

Once these are clear, your investment decisions become much easier and more disciplined.

Accounts Required to Invest in the Stock Market

To invest in the Indian stock market, you need a Demat account, a trading account, and a bank account linked together.

A Demat account holds your shares in electronic form, just like a bank account holds money. A trading account is used to place buy and sell orders on the stock exchange. The bank account is used for transferring funds when you invest or withdraw money.

Most modern brokers offer all three accounts together in a simple online process that can be completed within a few days.

Step-by-Step: How to Start Investing in Stock Market

This is the practical part that you should care about the most.

First, choose a reliable stock broker that is registered with SEBI. Look for transparency, ease of use, reasonable charges, and good customer support rather than fancy promises.

Second, open your Demat and trading account by submitting basic KYC documents such as PAN card, Aadhaar, bank details, and photographs.

Third, once your account is active, transfer money from your bank account to your trading account.

Fourth, decide what you want to invest in. As a beginner, it is better to start with safer and simpler options like index funds, ETFs, or well-diversified mutual funds rather than directly picking individual stocks.

Finally, place your first buy order using the trading app or website. Your investment will reflect in your Demat account after settlement.

Best Investment Options for Beginners

Beginners often think that investing means buying individual shares. In reality, there are multiple options, and some are much more suitable for first-time investors.

Mutual funds allow you to invest in a diversified portfolio managed by professionals. SIPs make investing disciplined and remove the stress of timing the market.

Index funds and ETFs track popular indices like Nifty 50 or Sensex. They are low-cost, transparent, and ideal for long-term investors who do not want to actively manage stocks.

Direct equity investing can be rewarding, but it requires learning fundamental analysis, patience, and emotional control. Beginners should approach it slowly and cautiously.

How to Analyse Stocks (Basic Understanding)

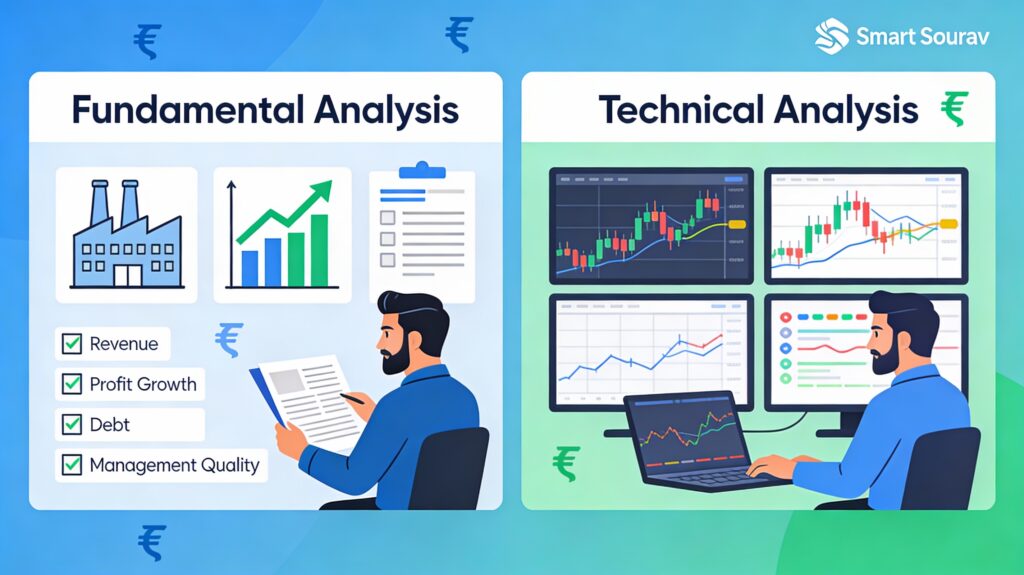

Stock analysis is broadly divided into fundamental analysis and technical analysis.

Fundamental analysis focuses on understanding the business itself. This includes studying what the company does, how it earns money, whether profits are growing, how strong its balance sheet is, and how good the management is.

Technical analysis focuses on price charts and patterns to identify trends and entry points. While useful, it is more relevant for traders than long-term investors.

As a beginner investor, your priority should always be understanding the business rather than predicting short-term price movements.

Building a Balanced Portfolio

A portfolio is simply a collection of all your investments. A good portfolio spreads risk across different assets instead of depending on one stock or sector.

Diversification helps reduce losses during market volatility. Over time, you should also review your portfolio periodically and rebalance it if any asset becomes too large or too small in proportion.

Remember, portfolio building is a long-term process, not a one-time activity.

Risk Management and Emotional Control

The stock market does not go up in a straight line. There will be ups and downs, sometimes sharp ones. Beginners often panic during market falls and sell at the worst possible time.

Successful investing requires patience, discipline, and emotional control. Investing only surplus money, maintaining an emergency fund, and avoiding daily price checking help a lot.

Risk is not eliminated by avoiding the market. It is managed by understanding what you own and staying invested for the long term.

Common Mistakes Beginners Must Avoid

Many beginners lose money not because the stock market is risky, but because of wrong behaviour.

Some common mistakes include blindly following tips, investing without understanding, overtrading, and expecting quick profits. Another significant mistake is stopping investments after a market decline instead of continuing them systematically.

Learning from these mistakes early can save you years of frustration.

Taxation on Stock Market Investments in India

Stock market returns are taxable, and every investor should understand the basics.

Profits from shares held for more than one year are taxed as long-term capital gains. Short-term gains are taxed differently. Dividends are also taxable as per your income slab.

You do not need to fear taxes, but you must be aware of them and plan accordingly.

To avoid confusion and last-minute surprises, it is always better to calculate taxes in advance rather than guessing them. You can use the Tax on Trading Profit Calculator (India) on SmartSourav.com to estimate capital gains tax, understand the difference between short-term and long-term taxes, and plan your investments more responsibly before filing returns.

Long-Term Habits of Successful Investors

Successful investors focus on consistency rather than excitement. They invest regularly, keep learning, avoid noise, and trust the power of compounding.

They understand that wealth is built slowly but steadily, not overnight.

If you develop the right habits early, investing becomes boring — and boring investing is usually profitable investing.

Final Thoughts: Your Next Step

Now you know how to invest in stock market as a beginner in India. You do not need perfect knowledge to start, but you do need the right mindset and a willingness to learn.

Start small, stay consistent, and focus on long-term growth rather than short-term profits. The stock market rewards patience far more than intelligence.

Ready to Take the Next Step?

Learning about the stock market is important, but planning and understanding the numbers make investing far more confident and disciplined. Before investing real money, take a few minutes to explore these beginner-friendly tools and guides on SmartSourav.com:

Common FAQs

What is the fundamental purpose of the stock market?

The stock market’s core purpose is to act as a bridge, connecting businesses that need capital for growth with investors who want to grow their wealth. It is where ownership stakes (shares) in companies are bought and sold.

Is the stock market gambling, or is it a regulated system?

It is a structured, regulated financial system. Bodies like the Securities and Exchange Board of India (SEBI) in India, the SEC in the U.S., and the FCA in the U.K. oversee markets to ensure transparency, enforce fair practices, and protect investors.

What is the difference between the Primary and Secondary Market?

The Primary Market is where a company sells its shares to the public for the first time, usually through an Initial Public Offering (IPO).

The Secondary Market is the everyday stock exchange (like NSE or BSE) where investors buy and sell already-issued shares from each other.

What is a Demat Account, and how is it different from a Trading Account?

A Demat account (Dematerialized account) is a digital vault used for securely holding your stocks and other securities electronically. A Trading account is the transaction tool used to buy and sell shares on the stock exchange. You need both to invest.

How do stock prices move, and what causes them to change?

Stock prices move constantly based on demand and supply dynamics. When there are more buyers than sellers (high demand), the price rises. They are also influenced by company performance (earnings), broader economic conditions (interest rates, GDP), and investor sentiment (fear and greed).

What are the main types of orders I can place to buy or sell a stock?

The main order types are:

Market Order: Executes immediately at the best available price.

Limit Order: Executes only at a specified price or better, giving price control but no guarantee of execution.

Stop-Loss Order: An order set to automatically sell a stock if it falls to a certain price, designed to limit potential losses.

What is the most common mistake beginners make?

A common mistake is a lack of diversification, such as investing too much money in a single stock or sector, which makes the entire portfolio vulnerable to the failure of a single company. Another is following unverified tips and rumors instead of doing proper research.

What are the essential first steps for a beginner to start investing?

1. Learn the basics of shares and market mechanics.

2. Choose a regulated and reliable broker.

3. Open the necessary Demat and Trading accounts.

4. Start with a small amount and focus on long-term investing and diversification (e.g., index funds or stable companies).

What is the biggest risk for a beginner investor?

One of the biggest risks is emotional and behavioural risk. Beginners often make costly mistakes by trading with fear and greed—panic selling during market dips or chasing high prices during rallies—instead of sticking to a rational, long-term strategy.

.

Disclaimer: This article is for educational and informational purposes only and does not constitute financial, investment, or tax advice. Any investment decisions you make are your own responsibility, and you should consider your personal situation and, if needed, consult a qualified financial professional before acting.

Tag:#InvestInIndia, #StockMarket, beginner guide to stock market india, how to invest in share market for beginners, how to invest in stock market in india, how to start investing in stocks in india, how to trade in indian share market, indian stock market basics for beginners, investing for beginners in india, investing in stocks, share market, share market for beginners, share market tips for beginners, stock market, stock market basics, stock market for beginners, stock market for beginners in india, stock market india, stock market investment for beginners in india