Social Security Benefits: The Complete Guide

Get Started with Social Security

Create your personal my Social Security account to access benefit estimates, application status, and manage your benefits online.

How Social Security Benefits Are Calculated

Understanding how Social Security calculates your benefit amount can help you make informed decisions about when to claim benefits and plan for your financial future.

The Calculation Process

Social Security uses a three-step process to calculate your benefit amount:

- Average Indexed Monthly Earnings (AIME): Your earnings are adjusted for inflation and averaged over your 35 highest-earning years.

- Primary Insurance Amount (PIA): A formula is applied to your AIME to determine your basic benefit amount.

- Adjustments: Your benefit is adjusted based on when you claim (before or after full retirement age).

Sample Calculation

For someone with an AIME of $6,000 in 2024:

| Calculation Step | Amount |

| 90% of first $1,174 of AIME | $1,056.60 |

| 32% of AIME between $1,174 and $7,078 | $1,544.32 |

| 15% of AIME over $7,078 | $0 |

| Primary Insurance Amount (PIA) | $2,600.92 |

Note: This is a simplified example. Your actual benefit will depend on your unique earnings history and when you claim benefits.

Retirement Age vs. Benefit Amount

| Birth Year | Full Retirement Age | Benefit at 62 | Benefit at Full Retirement Age | Benefit at 70 |

| 1943-1954 | 66 | 75.0% | 100% | 132.0% |

| 1955 | 66 and 2 months | 74.2% | 100% | 130.7% |

| 1956 | 66 and 4 months | 73.3% | 100% | 129.3% |

| 1957 | 66 and 6 months | 72.5% | 100% | 128.0% |

| 1958 | 66 and 8 months | 71.7% | 100% | 126.7% |

| 1959 | 66 and 10 months | 70.8% | 100% | 125.3% |

| 1960 and later | 67 | 70.0% | 100% | 124.0% |

Estimate Your Benefits

Use the official Social Security calculator to get a personalized estimate of your future benefits.

How to Apply for Social Security Benefits

Applying for Social Security benefits is a straightforward process that can be completed online, by phone, or in person. Here’s a step-by-step guide to help you through the application process.

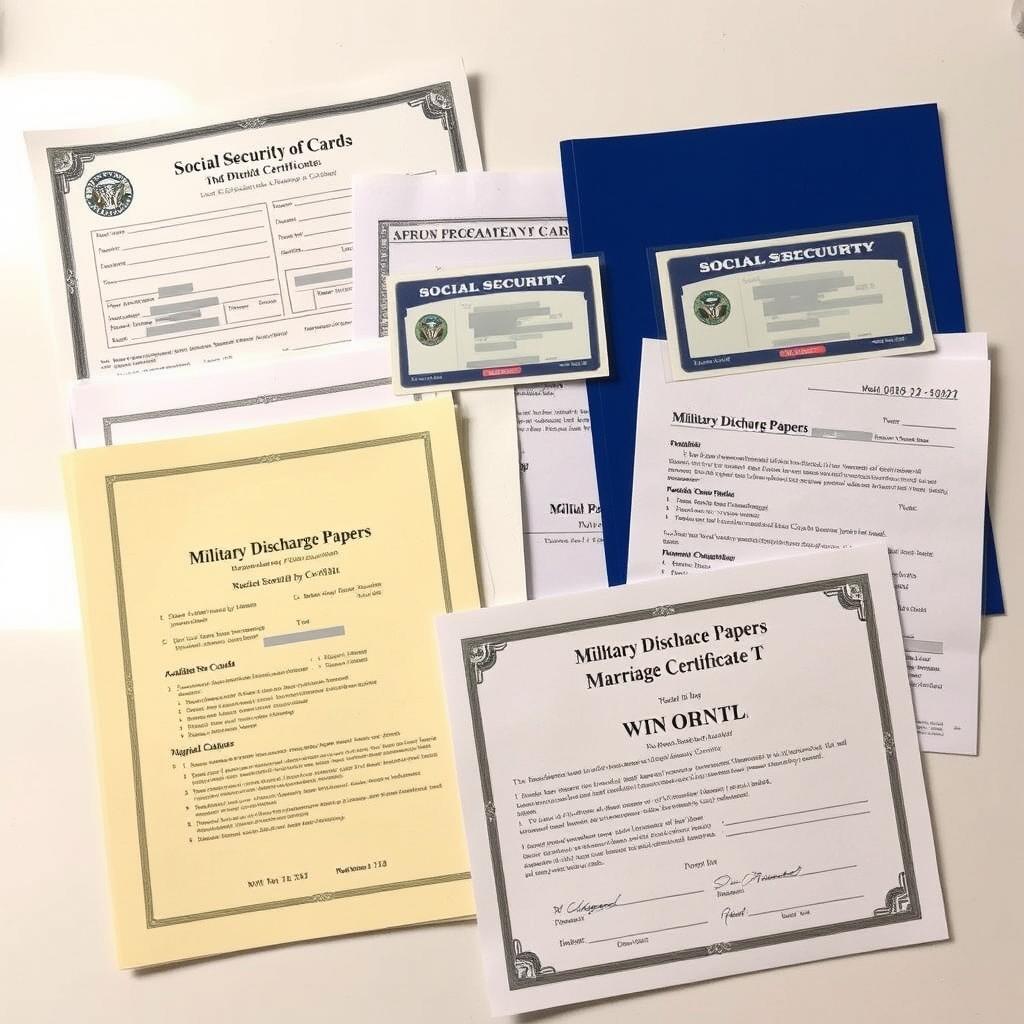

Step 1: Gather Required Documents

- Social Security number

- Birth certificate

- W-2 forms or self-employment tax returns for the past year

- Military discharge papers (if applicable)

- Marriage certificate (if applying for spousal benefits)

- Bank account information for direct deposit

Step 2: Choose Your Application Method

Online (Recommended)

The fastest and most convenient way to apply is through the SSA website. The online application takes about 15-30 minutes to complete.

By Phone

Call the SSA at 1-800-772-1213 (TTY 1-800-325-0778) Monday through Friday from 8 a.m. to 7 p.m.

In Person

Visit your local Social Security office. Appointments are strongly recommended.

Step 3: Complete the Application

When applying, you’ll need to:

- Provide personal information

- Answer questions about your work history

- Select when you want benefits to begin

- Choose your payment method

Application Timeline

You can apply up to 4 months before you want your benefits to start. Processing typically takes 2-6 weeks for retirement benefits and 3-5 months for disability benefits.

Ready to Apply?

Start your application process online through the official Social Security Administration website.

When Should You Claim Social Security?

Deciding when to claim Social Security benefits is one of the most important financial decisions you’ll make. The right timing depends on your personal circumstances, health, financial needs, and retirement plans.

Claiming at Age 62

Advantages

- Access to benefits sooner

- Can be helpful if you need income immediately

- May make sense if you have health concerns

- Could allow for early retirement

Disadvantages

- Permanently reduced benefits (up to 30%)

- May impact benefits for your surviving spouse

- Earnings limit applies if you continue working

Claiming at Age 70

Advantages

- Maximum possible monthly benefit (up to 32% more)

- Higher survivor benefits for your spouse

- No earnings limit if you continue working

- Better protection against longevity risk

Disadvantages

- Must wait longer to receive benefits

- May not be optimal if you have serious health concerns

- Need other income sources between retirement and age 70

Claiming at Full Retirement Age (66-67)

Claiming at your full retirement age represents a middle ground approach:

- You receive 100% of your earned benefit amount

- No earnings limit if you continue working

- Spousal benefits are maximized (50% of your benefit)

- You can choose to suspend benefits until age 70 to earn delayed credits

“The decision of when to claim Social Security benefits should be based on your individual circumstances, including your health, financial needs, and retirement plans. For many people, delaying benefits can significantly increase their lifetime income.”

Get Personalized Claiming Advice

Speak with a Social Security representative to discuss your specific situation and claiming options.

Taxes on Social Security Benefits

Many people are surprised to learn that Social Security benefits may be subject to federal income tax. Whether your benefits are taxable depends on your total income and filing status.

IRS Rules for Benefit Taxation

The IRS uses a measure called “combined income” to determine if your benefits are taxable:

Combined Income = Adjusted Gross Income + Nontaxable Interest + ½ of Social Security Benefits

Based on your combined income and filing status, up to 85% of your Social Security benefits may be subject to federal income tax.

Tax Brackets for Social Security Benefits

| Filing Status | Combined Income | Percentage of Benefits Taxable |

| Individual | Below $25,000 | 0% |

| Individual | $25,000 – $34,000 | Up to 50% |

| Individual | Above $34,000 | Up to 85% |

| Married Filing Jointly | Below $32,000 | 0% |

| Married Filing Jointly | $32,000 – $44,000 | Up to 50% |

| Married Filing Jointly | Above $44,000 | Up to 85% |

State Taxes: Most states don’t tax Social Security benefits, but 12 states do tax them to some extent: Colorado, Connecticut, Kansas, Minnesota, Missouri, Montana, Nebraska, New Mexico, Rhode Island, Utah, Vermont, and West Virginia.

Understand Your Tax Obligations

Learn more about how Social Security benefits are taxed and strategies to minimize your tax burden.

Social Security COLA (Cost of Living Adjustments)

To help beneficiaries maintain their purchasing power in the face of inflation, Social Security provides annual Cost of Living Adjustments (COLAs) to benefit amounts.

What is COLA?

The Cost of Living Adjustment is an annual increase in Social Security benefits designed to offset the effects of inflation. The adjustment is based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W).

When the CPI-W increases from the third quarter of one year to the third quarter of the next year, Social Security benefits increase by the same percentage. If there is no increase in the CPI-W, there is no COLA for that year.

Recent COLA History

| Year | COLA Percentage | Average Increase for Retired Worker |

| 2024 | 3.2% | $59 per month |

| 2023 | 8.7% | $146 per month |

| 2022 | 5.9% | $92 per month |

| 2021 | 1.3% | $20 per month |

| 2020 | 1.6% | $24 per month |

Important: COLA increases are announced in October and take effect with the December payment (received in January of the following year).

Taking the Next Step with Social Security Benefits

Social Security provides a foundation for financial security during retirement, disability, or after the loss of a family member. Understanding how these benefits work and making informed decisions about when and how to claim them can significantly impact your financial well-being.

Remember that Social Security was designed to replace only about 40% of pre-retirement income for average earners. For a secure retirement, it’s important to supplement these benefits with personal savings, investments, and possibly continued work.

Ready to Take Action?

Create your personal my Social Security account to access your statement, check your earnings record, estimate your benefits, and apply online when you’re ready.

Common Questions Americans Ask About Social Security

Can you work and receive Social Security benefits?

Yes, you can work and receive Social Security benefits, but there are some important considerations:

If you’re at full retirement age or older: You can work and earn any amount without affecting your benefits.

If you’re under full retirement age: There are earnings limits that can reduce your benefits temporarily.

For 2024, if you’re under full retirement age for the entire year, $1 in benefits will be deducted for every $2 you earn above $22,320. In the year you reach full retirement age, $1 in benefits will be deducted for every $3 you earn above $59,520 until the month you reach full retirement age.

Any benefits withheld due to excess earnings will be added back to your benefits after you reach full retirement age.

What happens if Social Security runs out of money?

According to the 2023 Social Security Trustees Report, the combined trust funds that pay retirement and disability benefits are projected to be depleted in 2034. However, this doesn’t mean Social Security will “run out of money” completely.

Even if the trust funds are depleted, Social Security will still collect tax revenue that can pay approximately 80% of scheduled benefits. This means that without legislative changes, beneficiaries would still receive about 80 cents for every dollar of scheduled benefits.

Congress has never allowed Social Security to fail to meet its obligations, and there are many policy options being discussed to address the long-term financing of the program, including:

Increasing the payroll tax rate

Raising or eliminating the cap on taxable earnings

Gradually increasing the full retirement age

Modifying the benefit formula

Changing the cost-of-living adjustment formula

How can I increase my Social Security benefit?

There are several strategies to potentially increase your Social Security benefit:

Work longer: Your benefit is based on your 35 highest-earning years. If you have fewer than 35 years of earnings, working longer will replace zeros in your calculation.

Earn more: Higher lifetime earnings result in higher benefits. Look for opportunities to increase your income through raises, promotions, or additional work.

Delay claiming: For each year you delay claiming beyond your full retirement age (up to age 70), your benefit increases by 8%.

Coordinate with your spouse: Married couples can coordinate their claiming strategies to maximize household benefits.

Check your earnings record: Review your Social Security statement regularly to ensure all your earnings are correctly reported.

Have More Questions?

Contact the Social Security Administration directly for personalized answers to your questions.

Available Monday through Friday, 8 a.m. to 7 p.m.

Disclaimer

This content is for informational and educational purposes only and does not constitute financial, tax, legal, or professional advice. Although we strive to provide accurate and up-to-date information, Social Security rules, income limits, COLA adjustments, and benefit formulas may change. Individual situations vary, and the information here may not apply to your specific circumstances. Always verify details through the official Social Security Administration website (SSA.gov) and consult with a licensed financial professional before making any financial decisions related to Social Security benefits.

Tag:Disability benefits, Retirement benefits, Social Security Administration, Social Security benefits in Alabama, Social Security benefits in Alaska, Social Security benefits in Arizona, Social Security benefits in Arkansas, Social Security benefits in California, Social Security benefits in Colorado, Social Security benefits in Connecticut, Social Security benefits in Delaware, Social Security benefits in Florida, Social Security benefits in Georgia, Social Security benefits in Hawaii, Social Security benefits in Idaho, Social Security benefits in Illinois, Social Security benefits in Indiana, Social Security benefits in Iowa, Social Security benefits in Kansas, Social Security benefits in Kentucky, Social Security benefits in Louisiana, Social Security benefits in Maine, Social Security benefits in Maryland, Social Security benefits in Massachusetts, Social Security benefits in Michigan, Social Security benefits in Minnesota, Social Security benefits in Mississippi, Social Security benefits in Missouri, Social Security benefits in Montana, Social Security benefits in Nebraska, Social Security benefits in Nevada, Social Security benefits in New Hampshire, Social Security benefits in New Jersey, Social Security benefits in New Mexico, Social Security benefits in New York, Social Security benefits in North Carolina, Social Security benefits in North Dakota, Social Security benefits in Ohio, Social Security benefits in Oklahoma, Social Security benefits in Oregon, Social Security benefits in Pennsylvania, Social Security benefits in Rhode Island, Social Security benefits in South Carolina, Social Security benefits in South Dakota, Social Security benefits in Tennessee, Social Security benefits in Texas, Social Security benefits in Utah, Social Security benefits in Vermont, Social Security benefits in Virginia, Social Security benefits in Washington, Social Security benefits in West Virginia, Social Security benefits in Wisconsin, Social Security benefits in Wyoming, Social Security Eligibility