What Is a Share? Stock vs Equity Explained

What Is a Share? Stock vs Equity Explained

If you are new to the stock market, three words will keep appearing again and again: share, stock, and equity. Most beginners hear these terms but don’t fully understand what they actually mean. As a result, investing feels confusing and risky.

In reality, these concepts are very simple. Once you understand them properly, the stock market stops feeling complicated and starts making sense—no matter which country you live in.

This guide explains everything using real-life examples and practical explanations that work anywhere in the world.

Table of Contents

What Is a Share? (Simple Explanation)

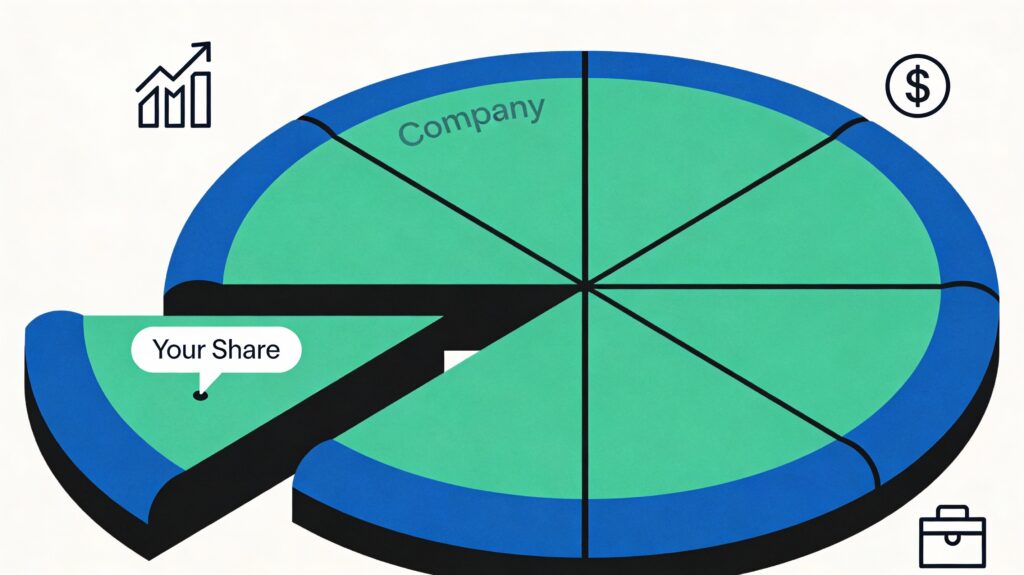

A share is a small unit of ownership in a company. When a company is created, its ownership is divided into many small parts. Each part is called a share. When you buy a share, you own a small portion of that company.

Think of a company like a large pizza. The pizza is divided into slices. Each slice represents a share. If you buy one slice, you own that part of the pizza. If you buy more slices, your ownership becomes larger. This is exactly how shares work.

Owning a share means you are not just a customer of the company—you are one of its owners. Even if your ownership is very small, it is still real and legally recognized.

Companies issue shares because they need money to grow. Instead of borrowing money from banks and paying interest, they sell ownership to the public. In return, investors get a chance to benefit if the company grows and becomes more valuable.

What Is a Stock?

The word stock is often used interchangeably with the word share, especially in countries like the United States. However, there is a small difference in meaning.

A share refers to one single unit of ownership in a company.

A stock refers to your total ownership in one or more companies.

For example, if you own shares of three different companies, all of them together are called your stock holdings. When someone asks, “What stocks do you own?” they are asking about all the companies you have invested in.

Globally, both words are widely accepted. Some countries prefer the word “share,” while others prefer “stock,” but both ultimately refer to owning part of a company.

What Is Equity?

Equity simply means ownership.

In the stock market, equity refers to the ownership you get when you buy shares of a company. If you own shares, you own equity in that business.

The term equity is also used in business and accounting. In that context, equity means the value left for owners after all debts are paid. That is why equity is often defined as:

Equity = Assets – Liabilities

In investing, you don’t need to worry too much about this formula. Just remember one thing: when people talk about equity markets or equity investing, they are talking about shares.

Share vs Stock vs Equity — Are They the Same?

These three terms are closely related but not exactly the same.

A share is a single unit of ownership.

A stock is a collection of shares you own.

Equity is the broader concept of ownership value.

In everyday conversation, people often use these words interchangeably, and that is completely fine. Even professionals do this. The important thing is to understand that all three terms point to the same idea: owning part of a company.

Types of Shares (With Simple Examples)

Companies issue different types of shares to meet different goals. Most beginners only need to understand the main ones.

Common shares are the most widely traded shares in the world. When people talk about buying shares in the stock market, they are usually talking about common shares. These shares give you ownership, voting rights, and the potential to receive dividends.

Preferred shares give shareholders priority when dividends are paid. They usually provide a fixed income but often do not include voting rights. These shares are generally less volatile than common shares.

Bonus shares are free shares given to existing shareholders. For example, if a company announces a 1:1 bonus, you receive one extra share for every share you already own.

Rights shares allow existing shareholders to buy additional shares at a discounted price. Companies use rights issues to raise extra funds while giving priority to current owners.

Partly paid shares require investors to pay only a portion of the share price initially, with the remaining amount paid later when the company asks for it.

These types exist in most markets around the world, though exact rules may vary slightly by country.

Why Companies Issue Shares

Companies issue shares mainly to raise money for growth. Expanding into new markets, developing new products, investing in technology, or reducing debt all require large amounts of capital.

By issuing shares, companies raise funds without taking loans. This strengthens their financial position and allows them to grow faster. At the same time, investors get the opportunity to participate in that growth by owning part of the company.

How Shares Work

The journey of a share is simple.

First, a company decides to raise money and offers its shares to the public through an IPO (Initial Public Offering). After the IPO, the shares are listed on a stock exchange such as the NYSE, NASDAQ, NSE, or other global exchanges.

Investors buy and sell these shares through licensed brokers or trading platforms. Once you buy a share, it is stored electronically in your brokerage or demat account. From that moment, you officially become a shareholder.

You can hold the shares for years or sell them at any time during market hours. The company does not control daily price movements—prices are decided by buyers and sellers in the market.

How Share Prices Move

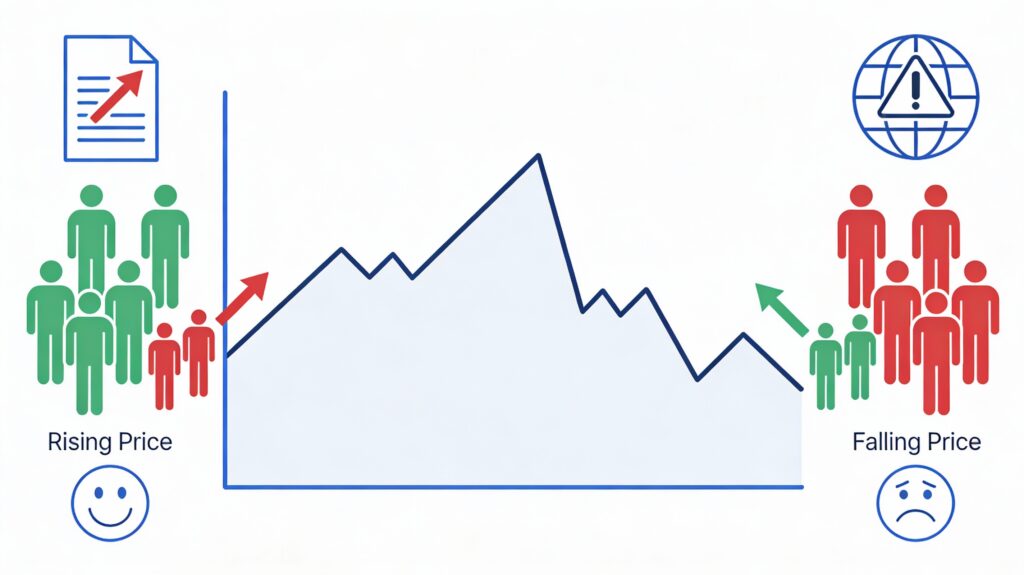

Share prices move because of demand and supply. When more people want to buy a share than sell it, the price goes up. When more people want to sell than buy, the price goes down.

Company performance plays a major role. Strong profits, good future prospects, and positive news usually push prices higher. Poor results, losses, or negative news push prices lower.

Global events such as interest rate changes, inflation, wars, or economic slowdowns also affect stock prices worldwide. On top of this, human emotions like fear and greed cause short-term fluctuations.

Benefits of Owning Shares

Owning shares allows your money to grow over time through capital appreciation. If the company becomes more valuable, the share price rises, increasing your wealth.

Some companies also pay dividends, which provide regular income. Shares are highly liquid, meaning you can buy or sell them easily. You can start investing with small amounts, diversify across industries and countries, and benefit from long-term compounding.

Historically, shares have been one of the best tools for building long-term wealth globally.

Risks of Owning Shares

Shares are not risk-free. Prices can fall due to market downturns, poor company performance, or global events. Emotional decisions like panic selling can increase losses.

There is also company-specific risk. Even well-known companies can fail. That is why diversification and long-term thinking are important.

The key is not to avoid risk completely, but to understand and manage it.

Common Mistakes Beginners Make

Many beginners buy shares without understanding the business. Others expect quick profits and panic during small price drops. Chasing trending stocks, investing all money in one company, or following social media tips blindly are also common mistakes.

Successful investors focus on learning, patience, diversification, and discipline rather than shortcuts.

Share Market Basics

No matter where you live, stock markets work in a similar way. Companies list shares on regulated exchanges. Investors trade through brokers. Regulators ensure fairness and transparency.

You usually need a government ID, a bank account, and a brokerage account to start investing. Markets operate on weekdays during fixed hours, which vary by country.

Final Thoughts

A share is a small piece of a company. A stock is the collection of shares you own. Equity means ownership. When you buy shares, you become a part-owner of a business.

If the business grows, your wealth grows. Shares offer powerful long-term benefits, but they also carry risks. Learning the basics and staying disciplined is the key to success.

Frequently Asked Questions (FAQ) about What is a Share:

Is share and stock the same?

They are closely related. A share is one unit; stock refers to total ownership.

Can beginners invest in shares?

Yes, if they start small, diversify, and think long-term.

Do shares guarantee profits?

No. Returns depend on company performance and market conditions.

Can I invest globally?

Yes. Many platforms allow international investing, subject to local rules.

Tag:#StockMarket, beginner stock market guide, common investing mistakes, equity investing for beginners, how share prices move, how to invest in stocks, learn stock market investing, long term investing, share market, share market basics, shares vs stocks, stock market, stock market for beginners, what is a share