What Is Nifty 50? A Simple Beginner Guide (Explained Clearly)

What Is Nifty 50?

If you are new to the Indian stock market, this is one of the first questions you will come across. The Nifty 50 is India’s most important stock market index, and it is used daily by investors, traders, mutual funds, and even the media to gauge the overall market direction.

In very simple words, Nifty 50 is an index that tracks the performance of the top 50 largest and strongest companies listed on the National Stock Exchange (NSE).

It is not a company, not a stock, and not something you can buy directly like a share. It is a single number that represents how these 50 companies are performing together.

You can think of Nifty 50 as India’s stock market scoreboard. When this number goes up, it means most large companies in India are doing well. When it goes down, it means they are facing pressure.

Table of Contents

What Is an Index or Indices in the Stock Market?

Before fully understanding Nifty 50, it is important to understand one basic stock market concept: what is an index. Many beginners skip this step, which later creates confusion.

In the stock market, an index is simply a number that represents the performance of a selected group of companies. Instead of tracking hundreds or thousands of individual stocks, an index combines important companies into one group and shows their overall performance through a single number.

If the prices of most companies included in an index go up, the index value rises. If the prices of most companies fall, the index value goes down. This makes an index a quick and simple way to understand market direction without checking every stock separately.

The plural of index is indices. So when you hear the term stock market indices, it simply means more than one index.

Different indices exist to track different parts of the market. For example, Bank Nifty (banking stocks), Nifty Pharma (pharmaceutical companies), Nifty IT (technology companies), Nifty Metal (metal and mining companies), and Nifty FMCG (consumer goods companies) are sector-specific indices that show how a particular industry is performing.

Similarly, there are broader indices like Nifty 50 (top 50 large companies) and Nifty Next 50 (next set of emerging large companies) that represent the overall market rather than a single sector.

In simple terms, an index works like a performance indicator. It helps investors, students, and beginners quickly understand whether a specific sector or the overall market is doing well or facing pressure.

Nifty 50 is the most important of these indices because it represents the performance of India’s top companies across multiple sectors, making it the primary benchmark of the Indian stock market.

Once you understand what an index is, understanding the Nifty 50 becomes very easy.

Full Form of Nifty 50

The full form of Nifty is National Stock Exchange Fifty.

“National Stock Exchange” refers to the NSE, and “Fifty” represents the 50 companies included in the index.

The name itself tells you exactly what it is: an index created by NSE that tracks fifty major companies.

Why the Nifty 50 Was Created

Before Nifty was launched in 1996, investors did not have a simple and reliable way to understand the overall direction of the Indian stock market. There were hundreds of companies and many sectors, but no single benchmark that could clearly answer one basic question: Is the Indian stock market going up or down?

To solve this problem, NSE created Nifty 50. The idea was simple but powerful. Instead of tracking thousands of stocks, track only the top 50 companies that have the biggest impact on India’s economy. By observing these companies, investors could understand market trends, economic strength, and investor sentiment using just one number.

Over time, the Nifty 50 became India’s official benchmark index, used by investors, mutual funds, analysts, and global institutions.

Nifty 50 as India’s Top 50 Companies: A Simple Analogy

Imagine the Indian economy as a large cricket tournament with thousands of players. You don’t need to watch every player to understand how strong the team is. You only need to watch the best players. If they perform well, the team performs well.

Nifty 50 works the same way. It includes the top 50 companies that represent the backbone of India’s economy. These companies come from major sectors such as banking, IT, FMCG, energy, automobiles, pharmaceuticals, and infrastructure. Together, they represent a very large portion of India’s total market value.

Because of this, tracking Nifty 50 is enough to understand how the broader market and economy are behaving.

What Does the Nifty 50 Represent?

Nifty 50 represents several important things at the same time. First, it represents the overall performance of the stock market. A rising Nifty usually indicates optimism and growth, while a falling Nifty reflects fear or uncertainty.

Second, it represents the health of India’s largest companies. Since these companies contribute significantly to GDP, employment, and tax revenue, their performance reflects economic strength.

Third, Nifty also represents investor sentiment. When investors feel confident about the future, they buy stocks, and Nifty rises. When they feel uncertain or fearful, they sell, and Nifty falls.

Finally, Nifty acts as India’s global market identity. Foreign investors track Nifty to judge how India compares with other major economies.

How Nifty 50 Is Calculated

To truly understand Nifty 50, you must understand how its value is calculated. Many beginners ignore this part, but once you understand it, Nifty will stop feeling confusing or random.

Nifty 50 is calculated using a method called free-float market capitalization. This sounds technical, but the idea behind it is actually very simple.

Let us start from the basics.

Every company listed on the stock market has something called market capitalization. Market capitalization means the total value of a company in the stock market. It is calculated by multiplying the company’s share price by the total number of shares.

For example, imagine a company whose share price is ₹1,000, and it has 10 crore shares in total. The market capitalization of this company would be ₹10,000 crore. This tells us how big the company is in market value terms.

However, here is the important point beginners usually miss. Not all shares of a company are available for public trading. A large portion of shares is usually held by promoters, founders, the government, or long-term strategic investors. These shares are not bought and sold every day in the market.

Because Nifty is meant to reflect actual market movement, it only considers the shares that are freely available for trading. This is called free-float.

So instead of using full market capitalization, Nifty uses free-float market capitalization.

Let us continue the same example. Suppose out of the 10 crore shares, only 50% are available for public trading. That means the free-float factor is 50%. In this case, the free-float market capitalization would be ₹5,000 crore, not ₹10,000 crore. This ₹5,000 crore is what Nifty considers for calculation.

Nifty 50 is calculated by adding the free-float market capitalization of all 50 companies included in the index. Each company contributes according to its size. Bigger companies contribute more, and smaller companies contribute less.

Now, let us look at a very simplified example to understand this clearly.

| Company | Free-Float Market Cap (₹ crore) | Contribution to Index |

| Company A | 5,000 | High impact |

| Company B | 3,000 | Medium impact |

| Company C | 2,000 | Lower impact |

| Total | 10,000 | Used for index calculation |

Imagine a mini Nifty index with only three companies.

Company A has a free-float market capitalization of ₹5,000 crore.

Company B has a free-float market capitalization of ₹3,000 crore.

Company C has a free-float market capitalization of ₹2,000 crore.

The total free-float market value of this mini index becomes ₹10,000 crore.

This total value is then divided by a fixed number called the index divisor. The divisor is used to keep the index value stable and comparable over time, even when companies issue bonus shares, split shares, or undergo restructuring.

Suppose the divisor is 100.

Then the index value would be 10,000 divided by 100, which equals 100 points.

Now imagine that the next day, due to rising share prices, the total free-float market value increases to ₹10,500 crore. The calculation becomes 10,500 divided by 100, which equals 105 points.

This means the index has risen by 5%.

This simplified example helps explain how changes in market value affect the Nifty 50 index. When the combined free-float value of the top 50 companies increases, Nifty goes up. When it decreases, Nifty goes down.

Another important thing to understand is weightage. Not all companies have equal weight in Nifty. Companies with larger free-float market capitalization have a higher weight and influence Nifty more. Smaller companies have lower weight and less impact.

That is why sometimes you may notice that even if many Nifty companies are falling, the index does not fall much. This usually happens when large, high-weight companies are stable or rising.

In simple words, Nifty 50 is a weighted index, not an average. It moves mainly based on the performance of the largest companies.

The free-float method is used because it gives a more realistic picture of the market. It reflects real buying and selling activity, not locked-in promoter holdings. This makes Nifty a fair and transparent indicator of market performance.

Once you understand this calculation logic, it becomes easier to see how Nifty reflects changes in market value. Every movement is backed by changes in company values, demand and supply, and investor activity.

Simple Takeaway

Nifty 50 is calculated by combining the free-float market value of its 50 companies and converting that value into a single number. Bigger companies move Nifty more, smaller companies move it less, and the index changes only when the real market value changes.

Which Companies Are Part of Nifty 50?

Nifty 50 includes 50 large, well-established companies listed on the National Stock Exchange (NSE). These companies are selected based on clearly defined criteria such as free-float market capitalization, liquidity, and overall eligibility requirements set by the NSE. The objective is to ensure that the index represents companies that have a significant impact on the Indian stock market and the economy.

The composition of the Nifty 50 index is not permanent. It is reviewed twice every year, and companies may be added or removed depending on changes in market size, trading activity, and other eligibility factors. This periodic review helps keep the index relevant and aligned with current market conditions.

Below is the list of companies included in the Nifty 50 index as of February 2026. This list is shared strictly for educational and informational purposes and should not be interpreted as any form of investment or trading recommendation.

Nifty 50 Companies List (As of February 2026)

| No. | Company Name | No. | Company Name | No. | Company Name | No. | Company Name | No. | Company Name |

| 1 | HDFCBANK | 11 | KOTAKBANK | 21 | TATASTEEL | 31 | INDIGO | 41 | COALINDIA |

| 2 | RELIANCE | 12 | M&M | 22 | BEL | 32 | JSWSTEEL | 42 | CIPLA |

| 3 | ICICIBANK | 13 | BAJFINANCE | 23 | ULTRACEMCO | 33 | BAJAJ-AUTO | 43 | HDFCLIFE |

| 4 | INFY | 14 | MARUTI | 24 | ASIANPAINT | 34 | TECHM | 44 | MAXHEALTH |

| 5 | BHARTIARTL | 15 | ETERNAL | 25 | HINDALCO | 35 | EICHERMOT | 45 | DRREDDY |

| 6 | LT | 16 | HINDUNILVR | 26 | SHRIRAMFIN | 36 | JIOFIN | 46 | TATACONSUM |

| 7 | SBIN | 17 | SUNPHARMA | 27 | BAJAJFINSV | 37 | SBILIFE | 47 | WIPRO |

| 8 | ITC | 18 | HCLTECH | 28 | BAJAJFINSV | 38 | TRENT | 48 | TMPV |

| 9 | AXISBANK | 19 | TITAN | 29 | ADANIPORTS | 39 | ONGC | 49 | APOLLOHOSP |

| 10 | TCS | 20 | NTPC | 30 | GRASIM | 40 | NESTLEIND | 50 | ADANIENT |

For the official list of Nifty 50 companies, see the NSE’s index tracker page: Nifty 50 Index – NSE

How Often Do Nifty 50 Companies Change?

Nifty 50 is reviewed twice a year. During these reviews, NSE checks whether the existing companies still meet the required criteria. If a company’s performance weakens or a new company becomes stronger and more eligible, changes are made.

Usually, only one or two companies are added or removed at a time. This ensures stability while keeping the index updated and relevant.

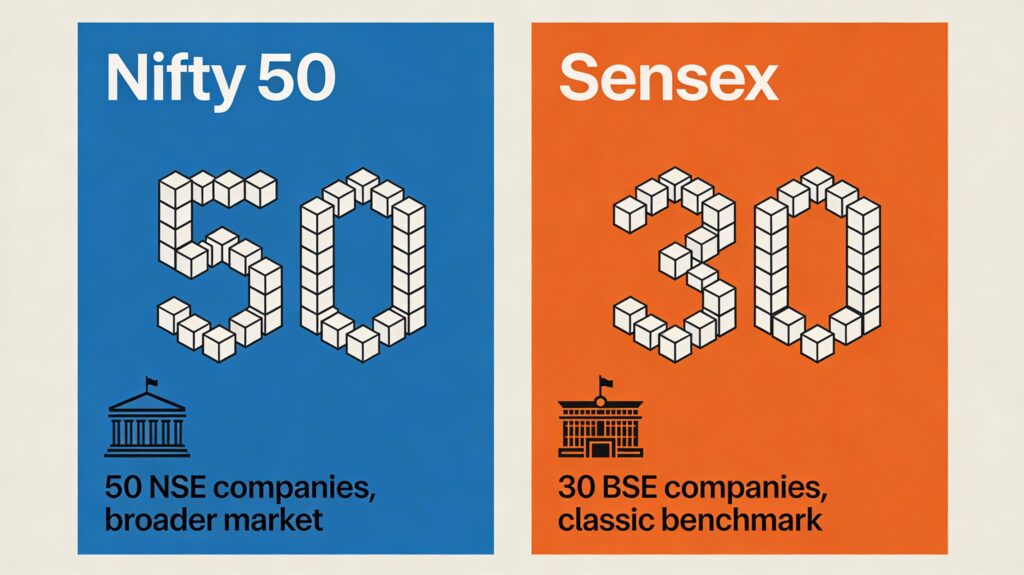

Nifty 50 vs Sensex: Simple Comparison

Nifty 50 and Sensex are both benchmark indices, but they are not the same. Nifty 50 tracks 50 companies listed on the National Stock Exchange, while Sensex tracks 30 companies listed on the Bombay Stock Exchange.

Because Nifty includes more companies, it offers broader market coverage. Both indices usually move in the same direction, but Nifty is more widely used today for trading, derivatives, and mutual fund benchmarking.

Why Does Nifty 50 Move Up or Down?

Nifty moves primarily because of demand and supply. When more investors buy stocks, prices rise, and Nifty goes up. When selling pressure increases, Nifty falls.

Other important factors include company earnings, global market movements, interest rate changes by the RBI, inflation data, GDP growth, government policies, crude oil prices, and foreign investor activity. Nifty reacts to all major economic and global events almost instantly.

Why Nifty 50 Is Important for Investors

Nifty 50 is important because it directly affects mutual funds, SIPs, index funds, and ETFs. Most large-cap mutual funds compare their performance against Nifty.

For beginners, Nifty provides a clear picture of market direction and helps avoid emotional decisions. For long-term investors, it represents India’s economic growth story and acts as a reliable benchmark.

How Beginners Should Use Nifty 50

Beginners should use Nifty as a learning tool, not a trading signal. Observing its daily movement helps understand market trends, sector performance, and the impact of news and global events.

For long-term investors, Nifty helps maintain discipline during market corrections and prevents panic selling. It also serves as a reference point to judge portfolio performance.

Common Mistakes Beginners Make

Many beginners assume that if Nifty rises, all stocks will rise. This is not true. Nifty reflects only large companies, not the entire market.

Another common mistake is panicking during corrections. Market declines are normal and temporary. Nifty has always recovered over the long term because it continuously replaces weak companies with stronger ones.

Beginners also make the mistake of watching Nifty every minute, which leads to stress and poor decisions. It is better to focus on trends rather than short-term fluctuations.

Final Thoughts on What is Nifty 50

Nifty 50 is India’s most important stock market index. It tracks the top 50 companies listed on NSE and represents the overall market direction, economic health, and investor sentiment. It is calculated using free-float market capitalization and reviewed twice a year. Understanding Nifty helps beginners learn the stock market faster and make better long-term decisions.

Frequently Asked Questions

What is Nifty 50 in simple words?

Nifty 50 is a number that shows how India’s top 50 companies are performing together.

Is Nifty 50 good for beginners?

Yes, it is the best starting point for understanding the Indian stock market.

Does Nifty 50 guarantee profits?

No, but historically it has delivered good long-term returns.

Can Nifty ever go to zero?

No, because it represents the strongest companies in India.

Can I buy Nifty 50 for 500 rupees?

Yes, through a mutual fund and an ETF.

Note: This content is for educational purposes only and should not be considered as investment or trading advice.