What Is Sensex? Meaning, Full Form & BSE Index Stocks List

If you follow financial news in India, you must have heard lines like “Sensex jumps 400 points” or “Sensex crashes today.” For beginners, this creates confusion.

What exactly is Sensex? Why does everyone talk about it? And how does it affect common investors?

This guide explains Sensex in simple language, using real-life analogies and practical examples so that even absolute beginners can understand it easily. You don’t need any finance background to understand this article.

Table of Contents

What Is Sensex? (Simple Explanation)

Sensex is the main stock market index of India. In very simple words, Sensex tells us whether the Indian stock market is doing well or badly on a given day.

You can think of Sensex as a summary number that represents the performance of India’s strongest and most trusted companies. Instead of checking thousands of stock prices every day, people look at Sensex to understand the overall market mood.

So when someone asks “What is Sensex?”, the simplest answer is this:

Sensex shows the performance of the top 30 companies listed on the Bombay Stock Exchange.

Sensex Full Form

The full form of Sensex is Sensitive Index.

It is officially known as the BSE Sensex, because it belongs to the Bombay Stock Exchange (BSE). BSE is Asia’s oldest stock exchange and one of the most respected exchanges in the world.

Whenever you hear the term Sensex index, BSE Sensex, or simply Sensex, all of them mean the same thing.

Why Sensex Was Created

Before Sensex existed, investors had no simple way to understand how the overall Indian stock market was performing. Individual stock prices were available, but there was no single indicator that reflected market health.

Sensex was created to solve this problem. Its main purpose is to track the performance of the Indian stock market using a small but powerful group of companies.

These companies are carefully selected to represent different sectors of the Indian economy, such as banking, IT, energy, FMCG, automobiles, and finance.

Because of this structure, Sensex acts like a thermometer of the Indian economy. When Sensex rises steadily, it usually means businesses are growing, and investor confidence is strong.

When it falls sharply, it often signals economic stress, fear, or uncertainty.

Sensex Is Like India’s Stock Market Report Card

To understand Sensex easily, imagine a school report card.

A report card does not show marks for every single exam ever conducted in the country. Instead, it summarises a student’s performance using a few important subjects. Similarly, Sensex summarises the Indian stock market by tracking only 30 top companies.

If most of these companies perform well, the Sensex goes up. If they perform poorly, the Sensex goes down. That is why Sensex is often called India’s stock market report card.

What Does Sensex Represent?

Sensex represents the overall performance of India’s largest and most influential companies. These companies are leaders in their industries and have a major impact on the economy.

Because Sensex includes companies from multiple sectors, it reflects how different parts of the economy are performing together. Banking growth, IT exports, consumer demand, manufacturing activity, and infrastructure development—all these factors influence Sensex movements.

In short, Sensex represents market sentiment, economic strength, and investor confidence in India.

How Sensex Is Calculated (Beginner-Friendly Explanation)

Sensex is calculated using a method called free-float market capitalization. While the name sounds technical, the idea is actually simple.

First, market capitalization means the total value of a company in the stock market. It is calculated by multiplying the share price by the total number of shares.

However, not all shares of a company are freely traded. Many shares are held by promoters, founders, or the government. These shares are not available for daily buying and selling. The shares that are available for public trading are called free-float shares.

Sensex calculation considers only the free-float market value of each of the 30 companies. The Bombay Stock Exchange adds the free-float market capitalization of all these companies and compares it with a fixed base value. This comparison gives us the Sensex number.

To keep things stable, Sensex uses a base year of 1986, with a base value of 100. So when Sensex is at 65,000 today, it means the value of India’s top companies has grown many times compared to that base year.

Which 30 Companies Are in the Sensex? (Complete List)

The Sensex is made up of 30 large, well-established companies listed on the Bombay Stock Exchange (BSE). These companies are selected because they are financially strong, actively traded, and represent key sectors of the Indian economy.

It is important to understand that this list is not permanent. The Bombay Stock Exchange reviews the Sensex periodically. If a company loses relevance or another company becomes more dominant, changes are made to ensure the index always reflects India’s current economic reality.

Complete BSE Index Stocks List (Sensex 30 Companies) as of February2026

This list is for educational purposes only and may change over time. Always confirm the latest constituents on the official BSE Sensex page before making investment decisions.

| No. | Company Name | No. | Company Name |

|---|---|---|---|

| 1 | ADANI PORTS AND SPECIAL ECONOM | 16 | Kwality Walls (India) Limited |

| 2 | ASIAN PAINTS LTD. | 17 | LARSEN & TOUBRO LTD. |

| 3 | AXIS BANK LTD. | 18 | MAHINDRA & MAHINDRA LTD. |

| 4 | BAJAJ FINANCE LIMITED | 19 | MARUTI SUZUKI INDIA LTD. |

| 5 | BAJAJ FINSERV LTD. | 20 | NTPC LTD. |

| 6 | BHARAT ELECTRONICS LTD. | 21 | POWER GRID CORPORATION OF INDI |

| 7 | BHARTI AIRTEL LTD. | 22 | RELIANCE INDUSTRIES LTD. |

| 8 | Eternal Limited | 23 | STATE BANK OF INDIA |

| 9 | HCL TECHNOLOGIES LTD. | 24 | SUN PHARMACEUTICAL INDUSTRIES |

| 10 | HDFC BANK LTD. | 25 | TATA CONSULTANCY SERVICES LTD. |

| 11 | HINDUSTAN UNILEVER LTD. | 26 | TATA MOTORS PASSENGER VEHICLES |

| 12 | ICICI BANK LTD. | 27 | TATA STEEL LTD. |

| 13 | INFOSYS LTD. | 28 | TECH MAHINDRA LTD. |

| 14 | ITC LTD. | 29 | TITAN COMPANY LIMITED |

| 15 | KOTAK MAHINDRA BANK LTD. | 30 | TRENT LTD. |

Official Index Constituents page on BSE India

This page shows the current 30 companies in the BSE Sensex as maintained by the exchange itself (updated regularly).

Why Only These 30 Companies Are Selected

The Sensex does not randomly choose companies. Each company must meet strict criteria related to market size, liquidity, trading frequency, and financial stability. These companies are leaders in their respective sectors and have a strong influence on the Indian stock market.

Because of this, even a small price movement in these companies can impact the Sensex significantly. That is why Sensex is considered a reliable indicator of the Indian market’s overall direction.

Important Things Beginners Must Remember

Seeing a company in the Sensex does not mean it is always a good investment. Sensex inclusion only means the company is large and influential. Investment decisions should always be based on proper research, financial goals, and risk capacity.

Sensex is a measurement tool, not a stock recommendation list.

Sensex vs Nifty (Clear Comparison)

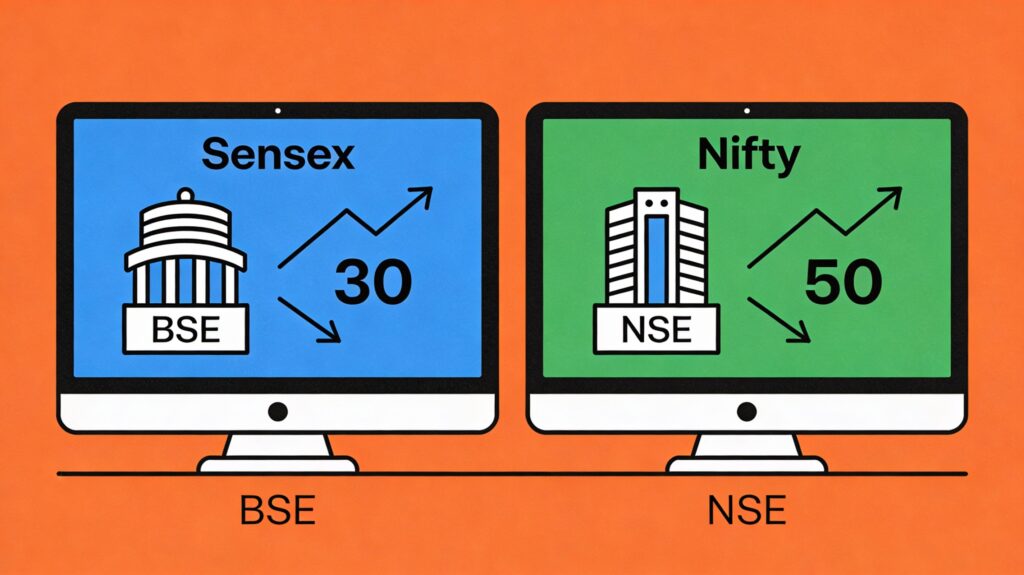

Many beginners confuse Sensex with Nifty. Both are stock market indexes, but they belong to different exchanges.

Sensex tracks top 30 companies listed on the Bombay Stock Exchange, while Nifty tracks top 50 companies listed on the National Stock Exchange (NSE).

Sensex is older and globally well-known, while Nifty is more actively used by traders in India.

Quick comparison table of Sensex and Nifty:

| Feature | Sensex | Nifty |

| Exchange | BSE | NSE |

| Companies | 30 | 50 |

| Base Year | 1986 | 1995 |

| Popularity | Global benchmark | Trading benchmark |

Both indices serve the same purpose: showing market direction.

Why Sensex Goes Up or Down

Sensex moves because share prices of its companies move. These movements are influenced by company results, economic conditions, government policies, interest rates, inflation, global events, and investor emotions.

When large investors like FIIs and mutual funds buy heavily, Sensex rises. When fear enters the market and selling increases, Sensex falls. In simple terms, Sensex moves because people buy and sell shares based on expectations.

Why Sensex Is Important for Investors

Sensex helps investors understand whether the market is in an uptrend, a downtrend, or a sideways phase. It acts as a benchmark to compare portfolio and mutual fund performance.

More importantly, Sensex teaches beginners an important lesson: markets grow over the long term but fluctuate in the short term. This understanding helps investors stay calm during market volatility.

How Beginners Should Use Sensex

Beginners should use Sensex as a learning and observation tool, not as a trading signal. Tracking the long-term trend of Sensex helps understand market cycles.

However, buying or selling stocks just because Sensex moved a few hundred points is a common beginner mistake.

Sensex should always be viewed along with sector trends, economic news, and long-term goals.

Common Misconceptions About Sensex

Many beginners believe that if Sensex rises, all stocks rise. This is not true. Sensex tracks only 30 companies, not the entire market.

Another myth is that Sensex is manipulated by a few players. In reality, Sensex reflects collective market behaviour driven by thousands of investors and institutions.

Final Thoughts on What is Sensex

Sensex is the Sensitive Index of the Bombay Stock Exchange. It tracks 30 large Indian companies and shows the overall market direction.

It is calculated using the free-float market capitalization method and acts as a benchmark for investors and mutual funds. Sensex helps understand market sentiment, but should not be used for impulsive trading decisions.

Frequently Asked Questions

What is Sensex in simple words?

Sensex is a number that shows how India’s top 30 companies are performing.

Are Sensex and BSE the same?

No. BSE is the exchange; Sensex is its main index.

How often do Sensex companies change?

Usually, during periodic reviews by BSE.

Is Sensex good for beginners?

Yes, it is one of the best tools to understand the Indian stock market.