Where’s My Refund? IRS Refund Status Guide to Avoid Delays

When to Expect Your Tax Refund

The IRS issues most refunds within 21 days of accepting your return. However, actual processing times vary based on several factors. Understanding these timeframes helps set realistic expectations while you wait.

| Filing Method | When to Check Refund Status | Expected Refund Timeframe |

| E-filed (current year) | 24 hours after acceptance | 21 days or less |

| E-filed (prior year) | 3-4 days after acceptance | Up to 6 weeks |

| Paper filed | 4 weeks after mailing | 6-8 weeks or longer |

| Amended returns | 3 weeks after filing | Up to 16 weeks |

Remember that these are general guidelines. During peak filing periods (January-April) or when staffing is limited, processing may take longer. After the IRS approves your refund, your bank may take up to a few business days to deposit the funds into your account.

Important: Filing electronically with direct deposit remains the fastest way to receive your tax refund. Paper returns and refund checks sent by mail significantly extend waiting times.

How to Check Your Refund Status

The IRS offers three official ways to check your refund status. Each method requires the same basic information, so have these details ready before you begin.

What You’ll Need to Check Your Refund

- Your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN)

- Your filing status (Single, Married Filing Jointly, etc.)

- The exact whole dollar refund amount shown on your tax return

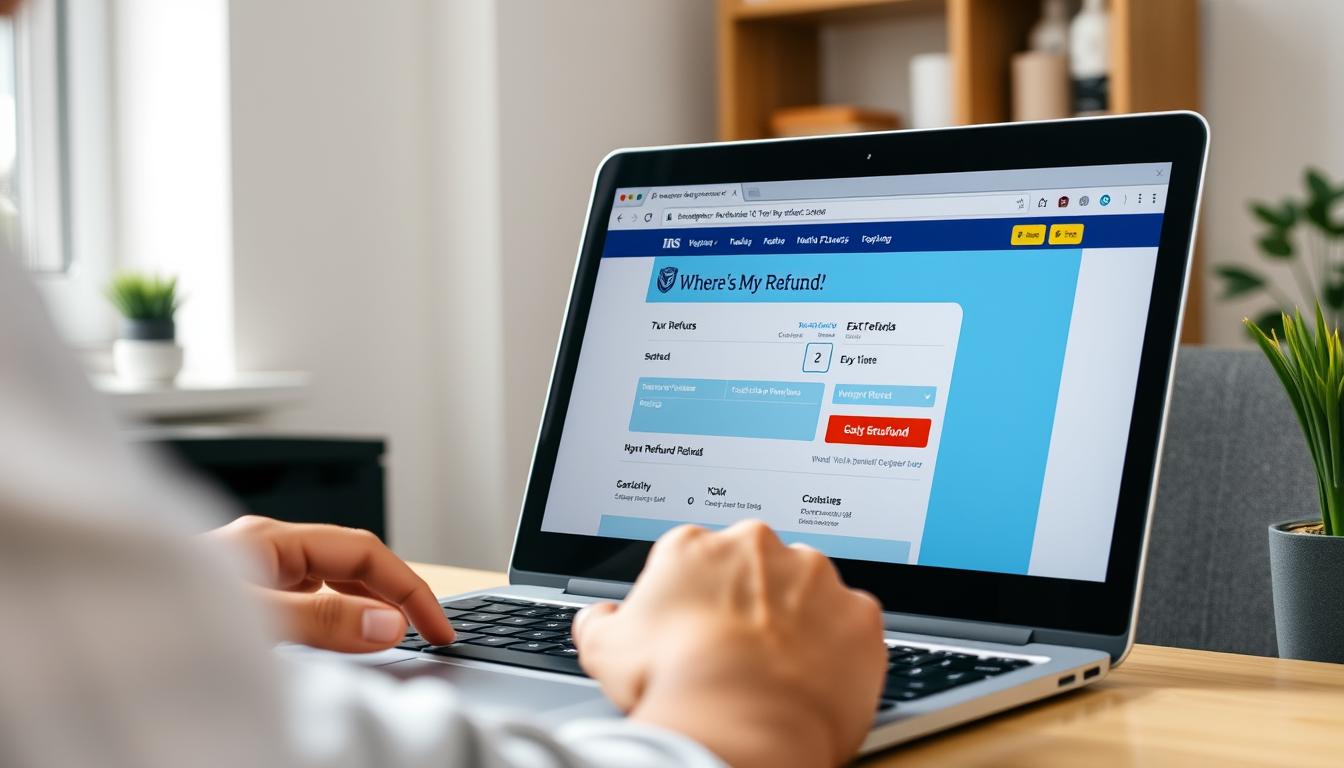

Option 1: IRS “Where’s My Refund?” Online Tool

The online tool is the most popular and convenient method for checking your refund status. It’s updated once every 24 hours, typically overnight.

Check Your Refund Status Online

Visit the official IRS “Where’s My Refund?” tool to check your refund status in minutes. Have your Social Security number, filing status, and exact refund amount ready.

Option 2: IRS2Go Mobile App

The IRS2Go app offers the same functionality as the online tool but in a mobile-friendly format. It’s free and available for both iOS and Android devices.

IRS2Go App Download Link for Android Device

IRS2Go App Download Link for iOS Device

IRS2Go App Features:

- Check refund status

- Make tax payments

- Access tax records

- Find free tax preparation assistance

- Stay connected with the IRS

Download the app from your device’s app store and follow the prompts to check your refund status.

Option 3: IRS Refund Hotline

If you prefer to speak with someone or don’t have internet access, you can call the automated IRS refund hotline.

The automated system provides the same information as the online tool. Have your Social Security number, filing status, and exact refund amount ready when you call.

Understanding Your Refund Status

When you check your refund status, you’ll see one of three messages. Each indicates a different stage in the refund process.

Stage 1 Return Received

![]()

The IRS has received your tax return and is processing it. This is the first stage of the refund process.

Stage 2 Refund Approved

![]()

The IRS has approved your refund and is preparing to send it. This stage includes the date when your refund will be issued.

Stage 3 Refund Sent

![]()

The IRS has sent your refund to your bank for direct deposit or mailed your check. Allow 5-7 business days for direct deposit or several weeks for mailed checks.

Refund Updates: The “Where’s My Refund?” tool updates once every 24 hours, usually overnight. Checking multiple times throughout the day won’t show new information. The system is typically unavailable between 4-5 a.m. Eastern time for daily updates.

To check an amended return, visit Where’s My Amended Return?

Common Refund Issues and Solutions

If your refund is taking longer than expected, there may be several reasons. Understanding these common issues can help you determine your next steps.

Why is my refund delayed?

Common reasons for delays include:

- Your return includes errors or is incomplete

- Your return requires further review

- Your return includes claims for certain credits (EITC or ACTC)

- Your return was affected by identity theft or fraud

- You filed a paper return during high-volume periods

If the IRS needs more information to process your return, they will contact you by mail. Do not respond to emails or phone calls claiming to be from the IRS, as these are likely scams.

Should I file a second return if my refund is delayed?

No, filing a second return typically delays processing further. Only file again if:

- You’re due a refund

- You filed on paper more than 6 months ago

- The “Where’s My Refund?” tool doesn’t show your return as received

If all three conditions apply, consider e-filing your return for faster processing.

What if my refund amount is different from what was expected?

If your refund is less than expected, the IRS may have:

- Corrected errors on your return

- Reduced your refund to pay past-due federal tax, state income tax, child support, or other federal debts

- Adjusted credits or deductions you claimed

The IRS will send a notice explaining any changes. If you disagree with the changes, follow the instructions in the notice to appeal.

Warning: The IRS will never initiate contact with taxpayers via email, text messages, or social media to request personal or financial information. If you receive such communications claiming to be from the IRS, do not respond or click on any links.

When to Contact the IRS

While the “Where’s My Refund?” tool provides most status updates, there are situations when you should contact the IRS directly about your refund.

Contact the IRS if:

- It’s been 21 days or more since you e-filed (6 weeks for paper returns), and the “Where’s My Refund?” tool directs you to contact the IRS

- You received a message indicating you need to provide additional information

- The “Where’s My Refund?” tool shows your refund was issued, but you haven’t received it after 5-7 days (direct deposit) or 4 weeks (mail)

Before calling, have your tax return, Social Security number, filing status, and any correspondence from the IRS ready. This will help the representative assist you more efficiently.

Checking State Tax Refunds

The IRS “Where’s My Refund?” tool only tracks federal tax refunds. If you’re also expecting a state tax refund, you’ll need to check with your state’s tax agency.

Popular State Refund Tools

State Processing Times

State tax refund processing times vary widely:

- E-filed returns: 2-3 weeks (typical)

- Paper returns: 8-12 weeks (typical)

- Returns with errors: Additional 4-8 weeks

Many states have their own “Where’s My Refund?” tools similar to the IRS version.

Information Needed

To check your state refund status, typically you’ll need:

- Social Security Number

- Expected refund amount

- Tax year

- Filing status

Some states may require additional information.

Find Your State’s Refund Tool

Visit your state’s department of revenue website to check your state tax refund status.

Tips for Faster Refunds Next Year

While you can’t speed up your current refund processing, these tips can help ensure faster refunds in future tax years.

Refund Acceleration Strategies

- E-file your return. Electronic filing is significantly faster than paper filing and reduces the risk of errors.

- Choose direct deposit. Direct deposit is up to 5 times faster than waiting for a paper check.

- File early in the tax season. Filing before the rush means your return gets processed before the IRS gets backlogged.

- Double-check for errors. Mistakes delay processing. Verify all Social Security numbers, math calculations, and supporting forms.

- Avoid claiming credits with known delays. Some credits, like the Earned Income Tax Credit (EITC), trigger additional review.

The combination of e-filing and direct deposit is by far the fastest way to receive your tax refund. This method typically results in refunds within 21 days for most taxpayers.

Conclusion

Tracking your tax refund doesn’t have to be stressful. The IRS “Where’s My Refund?” tool provides a straightforward way to monitor your refund’s progress through the system. Remember that most refunds are issued within 21 days of acceptance for e-filed returns, though various factors can extend this timeline.

If you encounter delays, first check your status through the official channels before contacting the IRS directly. In most cases, patience is required as the IRS processes millions of returns each year.

Ready to Check Your Refund Status?

Use the official IRS “Where’s My Refund?” tool to track your federal tax refund. Have your Social Security number, filing status, and exact refund amount ready.