The Truth About How Stock Market Works (Beginners Must Read!)

The share market, or stock market, is one of the most important financial systems in the world. It may look complicated at first—filled with charts, numbers, and confusing terms like exchanges, brokers, IPOs, bulls, and bears—but the basic idea behind it is quite simple.

The stock market is a global marketplace where people buy and sell pieces of ownership in companies, known as shares. These shares allow individuals, institutions, and even governments to participate in the growth of businesses and economies.

When companies perform well, or investors expect them to perform well, the value of their shares usually increases. When expectations fall, so do share prices. This constant movement of prices is what creates opportunities for investors and traders across the world.

For beginners, understanding how stock market works is the first and most important step toward smart investing. You don’t need to be an expert or have a finance degree to grasp the basics. Once you understand why companies issue shares, how exchanges function, how trades are settled, and what drives prices up or down, everything else becomes significantly easier.

This guide will walk you through the entire process—from the core purpose of the stock market to IPOs, trading mechanisms, global examples, investor psychology, risks, and best practices—explained in the simplest possible language.

By the end, you will have a clear, global-level understanding of how stock market works and how you can participate in it confidently.

Table of Contents

What Is the Share Market?

The share market, also known as the stock market or equity market, is a global platform where people buy and sell small pieces of ownership in companies, called shares or stocks.

When you purchase a share, you own a tiny portion of that company, which means you benefit when the company grows and its value increases. At the same time, you share some of the risks if the business performs poorly.

Every major country operates its own stock exchanges where this buying and selling takes place—such as the New York Stock Exchange and NASDAQ in the United States, the London Stock Exchange in the UK, the Tokyo Stock Exchange in Japan, or the NSE and BSE in India.

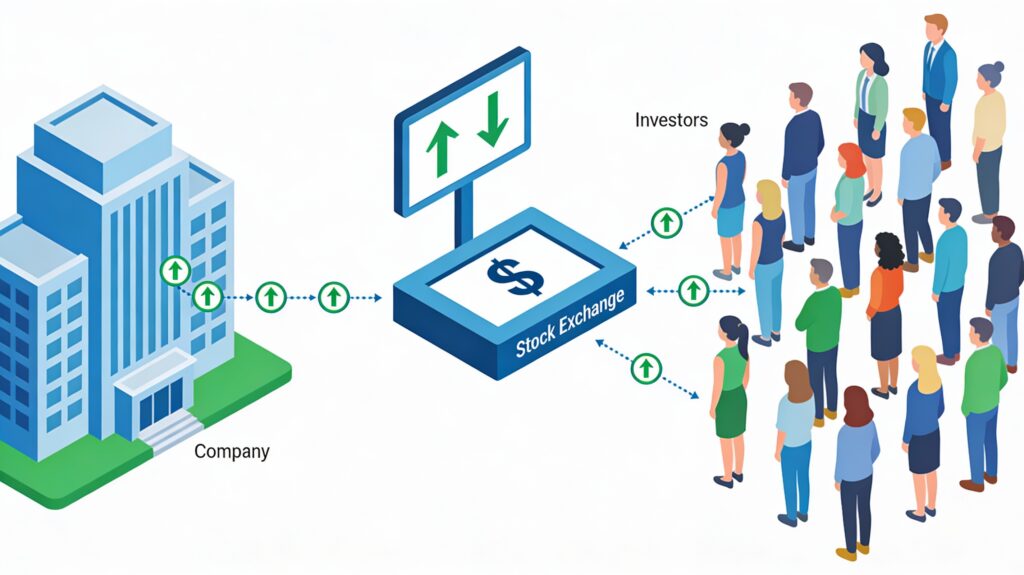

Despite differences in geography, technology, and regulations, the core concept remains universal: the stock market exists to connect companies that need money with investors who want to grow their wealth.

The share market plays a vital role in modern economies. Companies come to the market to raise capital for expansion, innovation, hiring, technology upgrades, debt repayment, and many other goals.

Instead of taking large loans, they sell ownership to the public in exchange for funds. Investors participate because the stock market gives them the possibility of higher long-term returns compared to traditional savings accounts or fixed-income instruments. This creates an ecosystem where businesses can grow, and individuals can build wealth simultaneously.

At its heart, the share market is simply a giant auction that never stops. Prices keep changing every second based on what buyers and sellers around the world think a company is worth.

When more people want to buy a stock, the price tends to increase. When more people want to sell, the price tends to decrease. This constant negotiation of value is what makes the market dynamic and exciting.

Most importantly, the share market is not gambling or guesswork. It is a structured, regulated financial system built on rules, transparency, and data.

Regulatory bodies—such as the SEC in the United States, FCA in the UK, and SEBI in India—exist to protect investors, enforce fair practices, and ensure that companies share accurate information with the public.

This regulation is what makes stock markets one of the safest and most efficient ways to invest globally, provided investors understand the basics and make informed decisions.

Why the Share Market Exists

The share market exists for one fundamental reason: it creates a bridge between businesses that need capital and people who want to grow their wealth. Every company—whether it is a global tech giant, a manufacturing firm, or a fast-growing startup—needs money to expand operations, hire more employees, launch new products, or enter new markets.

Instead of relying only on bank loans or private investors, companies can raise funds by offering a portion of their ownership to the public in the form of shares. This process gives businesses access to large amounts of capital quickly, without the burden of fixed repayments or high interest costs.

For investors, the share market provides a powerful opportunity to participate in the growth of these companies. When individuals buy shares, they become partial owners and gain the potential to earn returns through rising stock prices and, in some cases, dividends.

This makes the stock market one of the most accessible and effective wealth-building tools available globally. People across the world—from the United States to Europe, India, Japan, and beyond—use the stock market to grow their savings, beat inflation, build retirement portfolios, and diversify their financial assets.

The market also benefits the overall economy. When companies raise funds and expand, they create jobs, pay taxes, innovate, and contribute to national and global economic growth.

A healthy stock market often reflects a strong economy because it shows that businesses are confident, investors are willing to put money into the future, and capital is being allocated efficiently. In this way, the share market becomes a critical engine that supports long-term development and financial stability.

Beyond funding and investment, the share market promotes transparency and accountability. Public companies are required to disclose their financial performance regularly, follow strict regulations, and operate under the supervision of regulatory bodies like the SEC (United States), FCA (United Kingdom), or SEBI (India).

This ensures that investors have access to accurate and timely information, making the global stock market one of the most regulated and trusted financial systems.

Ultimately, the share market exists because it benefits everyone involved: companies get access to growth capital, investors get a chance to build wealth, and economies gain fuel for progress.

It is a system designed to distribute opportunity widely and efficiently, which is why it plays such an indispensable role across the world today.

How Stock Market Works

The share market works through a simple and universal process that applies across major economies—from the United States and Europe to India and Asia. It begins when a company needs capital to grow. Instead of relying only on bank loans or private investors, the company chooses to raise money from the public by offering shares.

This first sale of shares happens through an Initial Public Offering (IPO). Before launching an IPO, the company prepares detailed financial disclosures and works with investment banks to fix the share price range and the number of shares to be offered.

Regulatory bodies such as the SEC (U.S.), FCA (UK), or SEBI (India) review these documents to ensure that the offering is transparent and safe for investors.

Once the IPO opens, investors can apply to buy these newly issued shares. If the offering is successful, the shares are listed on a stock exchange—for example, the NYSE or NASDAQ in the U.S., LSE in the UK, or NSE and BSE in India.

After listing, the shares move into the secondary market, where investors buy and sell shares with each other rather than directly with the company. From this point onward, the company no longer controls the price. Instead, the price is determined entirely by market forces.

Trading in the secondary market follows a continuous auction model. Investors place buy or sell orders through brokers, and the stock exchange automatically matches them.

Stock prices move constantly because they reflect real-time negotiations between buyers and sellers across the world. When more people want to buy a stock, the price rises; when more people want to sell, the price falls. This simple demand–supply mechanism drives price movement everywhere, regardless of country.

To make the process clearer, here is the global stock market workflow in simplified points:

- A company decides to raise funds from the public.

- It files an IPO after regulatory approval.

- Shares become available for purchase by investors.

- The company is lists on one or more stock exchanges.

- Investors trade these shares freely in the secondary market.

- Prices fluctuate based on demand, supply, news, and expectations.

- Completed trades are settled by clearing corporations and depositories.

After each trade, a settlement process ensures that money and shares are transferred securely. Modern markets use fast settlement cycles. India now follows T+1 settlement, meaning trades are settled the next business day.

Many developed markets are moving toward similar speeds. Clearing corporations verify transactions, while depositories store shares electronically in investor accounts, making the entire workflow efficient and secure.

In essence, the stock market operates through a globally consistent system—capital raising, listing, trading, price discovery, and settlement. While each country has its own rules and regulators, the underlying mechanism remains universal, allowing investors around the world to participate with clarity and confidence.

Stock Market Structure Around the World

Although different countries operate their stock markets under unique regulatory frameworks, the overall structure of global financial markets is remarkably similar. At the foundation of every stock market is a regulatory authority responsible for ensuring fairness, transparency, and investor protection.

In the United States, this role is handled by the Securities and Exchange Commission (SEC); in the United Kingdom, it is the Financial Conduct Authority (FCA); in India, it is the Securities and Exchange Board of India (SEBI). These regulators enforce rules, monitor trading activity, prevent fraud, and ensure that companies disclose accurate financial information before and after they go public.

Stock exchanges form the next essential layer of market structure. They act as digital marketplaces where buyers and sellers meet to trade shares. Some of the world’s major exchanges include the New York Stock Exchange (NYSE) and NASDAQ in the United States, the London Stock Exchange (LSE) in the United Kingdom, the Tokyo Stock Exchange (TSE) in Japan, and the National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) in India. Each exchange provides the infrastructure needed to match buy and sell orders instantly, maintain price transparency, and ensure liquidity so investors can easily enter or exit positions.

Behind the scenes, clearing corporations play a critical role in ensuring that trades are completed smoothly. When a transaction occurs, the clearing corporation guarantees that both parties fulfill their obligations: the buyer receives the shares, and the seller receives the money. This eliminates counterparty risk and maintains trust in the financial system. Clearinghouses in the U.S., Europe, and Asia operate under strong regulatory oversight to safeguard market stability.

Depositories form the next layer of the structure. Instead of holding physical certificates, modern markets store shares electronically in digital accounts. In the United States, securities are held through the Depository Trust Company (DTC). In the UK, CREST performs this function, and in India, two depositories—NSDL and CDSL—manage electronic holdings. Depositories ensure that investors’ shares are protected, accurately recorded, and transferred securely during every trade.

Finally, brokers and financial intermediaries connect investors to the stock exchange. Whether you use a discount broker, a full-service broker, a mobile app, or a trading platform, these intermediaries serve as your gateway to the market.

They handle order execution, maintain your trading and investment accounts, and comply with regulatory requirements on your behalf. Without brokers, retail investors would not be able to access stock exchanges directly.

Together, regulators, exchanges, clearing corporations, depositories, and brokers form a unified structure that allows the global stock market to operate efficiently. While technology and regulations may vary from one country to another, this layered system ensures that markets remain reliable, liquid, safe, and accessible to investors worldwide.

Primary Market vs Secondary Market

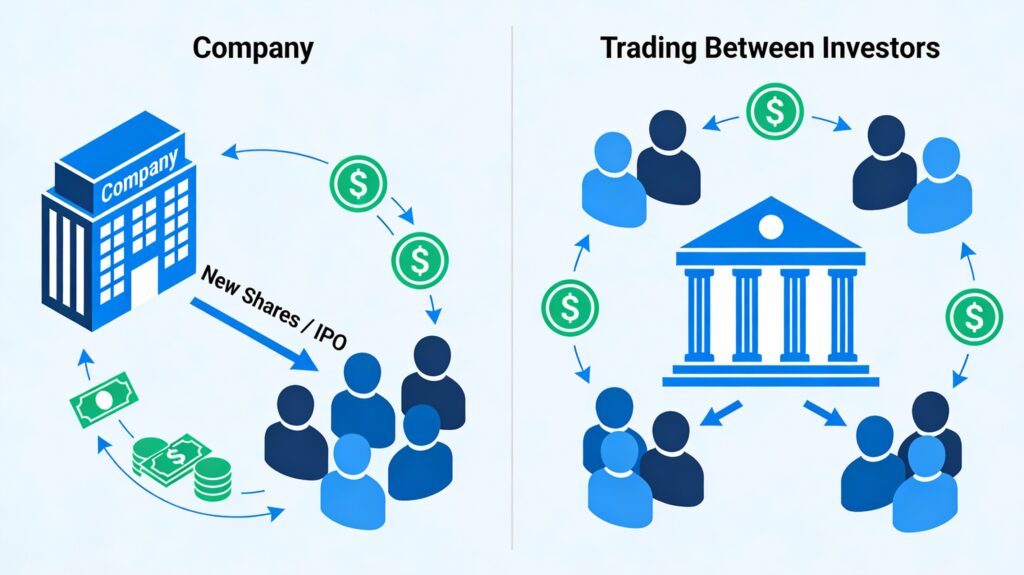

Primary Market

The primary market is the first stage of the share market, where a company sells its shares to investors directly for the very first time. This usually happens through an Initial Public Offering (IPO), although companies may also raise capital through Follow-On Public Offerings (FPOs), rights issues, or private placements.

In the primary market, the money raised goes straight to the company, allowing it to fund expansions, build infrastructure, invest in technology, or strengthen its financial position. Investors who participate receive freshly issued shares that did not exist before.

Since the primary market involves the creation and sale of new shares, it plays a critical role in global capital formation, helping businesses secure the funds they need to grow and innovate. Regulatory authorities in each country closely monitor this process to protect investors and ensure companies provide transparent information.

Secondary Market

Once a company completes its IPO and its shares are allotted, those shares begin trading freely in the secondary market. This is the everyday stock market that most people are familiar with—the place where investors around the world buy and sell shares with one another through stock exchanges such as the NYSE, NASDAQ, London Stock Exchange, Tokyo Stock Exchange, NSE, or BSE.

In the secondary market, the company is no longer involved in the transaction, and it receives no money from these trades. Instead, investors trade among themselves, and prices constantly change based on demand, supply, news, economic data, and expectations about the company’s future.

The secondary market provides essential liquidity because it allows investors to exit or enter positions at any time. Without a functioning secondary market, the primary market would not work effectively, as investors would hesitate to buy newly issued shares if they could not later sell them easily.

Key Participants in the Global Share Market

The global share market is a vast ecosystem made up of many different participants, each playing a unique and essential role in keeping the system active, liquid, and efficient. At the foundation are individual retail investors—everyday people who buy and sell shares using their personal money. They form a large portion of market activity worldwide and participate in long-term wealth creation, retirement planning, or short-term trading opportunities.

Alongside them are professional traders who operate with more advanced strategies, often focusing on short-term price fluctuations using technical analysis, algorithmic systems, or derivatives. These professional traders add liquidity and help ensure that markets remain active throughout the trading day.

Large institutional investors form another major group. These include mutual funds, pension funds, insurance companies, hedge funds, and sovereign wealth funds. Institutions manage enormous pools of capital on behalf of millions of people, and their investment decisions can significantly influence market direction and sentiment.

In many countries, foreign institutional investors (FIIs) and domestic institutional investors (DIIs) play a particularly important role because their large-scale buying or selling can move markets sharply. Their decisions are typically based on deep research, economic forecasts, and long-term investment models.

Stockbrokers and financial intermediaries serve as the bridge between investors and the stock exchanges. Individual investors cannot trade directly on exchanges; instead, they must use brokers who are licensed and regulated by financial authorities.

Brokers provide trading platforms, manage trading accounts, and route investor orders to the exchange. Modern online brokers and mobile trading platforms have made global markets more accessible than ever before, allowing people from almost any part of the world to invest with ease.

Behind the scenes, clearing corporations and depositories maintain the structure that ensures trades are executed safely and accurately. Clearing corporations verify and guarantee trades, ensuring that both sides of a transaction are fulfilled even if one party defaults.

Depositories—such as the Depository Trust Company (DTC) in the United States, CREST in the UK, and NSDL or CDSL in India—hold securities electronically, so investors no longer need physical share certificates. They ensure that shares move securely from seller to buyer during settlement.

Regulatory bodies form the final and most critical layer of market participants. Organizations like the SEC in the United States, the FCA in the UK, and SEBI in India oversee the entire system, create rules that protect investors, prevent manipulation, enforce transparency, and promote fairness.

Without these regulators, markets would be unsafe and unreliable. Together, all these participants—investors, traders, institutions, brokers, clearing agencies, depositories, and regulators—create a balanced, interconnected network that keeps the global share market functioning smoothly.

What Is a Demat Account and Trading Account?

In the modern share market, investors no longer receive physical certificates when they buy a stock. Instead, all shares are held electronically, and to store these digital securities, every investor needs a Demat account. A Demat account—short for “dematerialized account”—acts like a digital vault where your stocks, bonds, ETFs, and other securities are safely stored.

Whether you’re investing in the United States, the United Kingdom, India, or any other developed market, the concept remains the same. In the U.S., securities are held through systems connected to the Depository Trust Company (DTC); in the UK, they are managed through the CREST system; and in India, depositories like NSDL and CDSL perform this role.

The purpose of the Demat account is universal: to keep your investments secure, eliminate the risks associated with paper certificates, and make the transfer of shares seamless.

Alongside the Demat account, investors also need a trading account. While the Demat account is meant for storing securities, the trading account is used to actually buy and sell them on the stock exchange.

Think of the trading account as the transaction tool that connects you to the market. When you place an order to purchase a stock, your trading account sends the order to the exchange through your broker. Once the trade is executed, the shares are transferred to your Demat account after settlement. Similarly, when you decide to sell, your trading account executes the sale, and the shares are moved out of your Demat account and delivered to the buyer.

Both accounts work together to give you access to the global share market. Without a trading account, you cannot execute buy or sell orders, and without a Demat account, you cannot hold the securities you purchase.

Brokers worldwide generally provide both accounts as a package, making it simple for investors to open, manage, and monitor their holdings using a single platform. This dual-account system ensures safety, transparency, and efficiency, forming the backbone of modern investing.

How Stock Prices Move

Stock prices move because markets are constantly reacting to new information, changing expectations, and investor behaviour. Although price movement looks complicated on the surface, it can be understood clearly through a few core factors that influence demand and supply in every global market, whether it is the NYSE, NASDAQ, NSE, or BSE.

1. Demand and Supply Dynamics

At the heart of every price change is the balance between buyers and sellers. When more people want to buy a stock, demand increases, and the price naturally rises. When more people want to sell, supply increases, and the price declines. This basic principle governs all stock markets worldwide.

2. Company Performance and Earnings

A company’s quarterly results, sales growth, profitability, product success, debt levels, and future guidance strongly influence its stock price. Positive financial performance attracts buyers, pushing the price higher, while weak or disappointing performance often leads to selling pressure and price decline.

3. Economic Conditions

Broader economic indicators such as GDP growth, inflation rates, unemployment levels, currency movements, and central bank policies affect stock prices. For example, when interest rates rise, borrowing becomes costlier for businesses, which can slow growth and negatively impact stock valuations. Conversely, strong economic outlooks often lift market sentiment.

4. Market Sentiment and Investor Psychology

Stock prices react heavily to investor emotions. Fear, greed, optimism, and panic can move markets faster than fundamentals. During uncertain periods, even minor negative news can trigger sharp declines, while positive momentum during optimistic phases can push prices higher than expected.

5. Institutional Investor Activity

Large institutions—such as mutual funds, pension funds, hedge funds, and foreign investors—buy and sell in significant quantities. Their actions can create major price swings. A large purchase can drive a stock upward, while heavy institutional selling can cause noticeable declines.

6. Global Events and International Markets

Modern markets are deeply interconnected. A major event in one country—such as geopolitical tension, policy change, a global pandemic, or a crash in another stock market—can immediately influence stock prices globally. Today’s digital markets adjust within seconds to international developments.

7. Industry and Sector Trends

If a particular industry shows strong growth prospects—like technology, renewable energy, or healthcare—stocks within that sector often rise together. Similarly, negative trends affecting a sector can push many related stocks downward regardless of individual performance.

Order Types in the Share Market

When investors buy or sell shares, they must choose how they want their trade to be executed, and this is done by selecting an appropriate order type. Although technology and interfaces vary across countries, the fundamental order types used globally remain largely the same.

1. Market Order

A market order is the simplest and fastest way to buy or sell a stock. When an investor places a market order, they are agreeing to trade immediately at the best available price. This type of order is ideal when quick execution is more important than the exact price. However, in fast-moving markets or in stocks with low liquidity, the final executed price may differ slightly from what the investor expected.

2. Limit Order

A limit order allows the investor to specify the exact price at which they want to buy or sell. A buy limit order will only execute at the chosen price or lower, and a sell limit order will execute at the chosen price or higher. This gives investors precise control over price but does not guarantee that the order will execute if the market never reaches the specified level.

3. Stop-Loss Order

A stop-loss order is designed to protect investors from significant losses. The investor sets a trigger price, and when the stock reaches that level, the stop-loss order becomes active. Depending on the platform and strategy, the triggered order may behave like a limit order or a market order. This helps investors automate risk management, especially when they cannot monitor the market continuously.

4. Trailing Stop Order

In many global markets, investors can use trailing stops, which automatically adjust as the stock price moves in their favor. This allows investors to lock in profits while still giving the stock room to grow. The trailing stop follows the stock upward (for long positions) but stays fixed if the stock begins to fall, triggering a sale if the decline reaches the set threshold.

5. Good-Till-Cancelled (GTC) or Good-Till-Triggered (GTT) Orders

Some exchanges and brokers allow investors to place orders that remain active for days, weeks, or even months until they are executed or cancelled. These long-duration orders are useful for investors who aim to buy or sell at specific price levels without constantly watching the market. Terms like GTC, GTT, or similar variations may be used depending on the region and platform.

6. After-Market or Pre-Market Orders

Many global markets offer trading sessions outside regular hours. After-market and pre-market orders allow investors to place trades during these extended hours, though liquidity is generally lower and prices may be more volatile. These orders help investors react to news events that occur before or after normal trading sessions.

How Beginners Can Start Investing in the Share Market

For beginners, entering the share market may feel overwhelming at first, but the process becomes simple once you understand the essential steps. Here is the step-by-step process:

1. Learn the Basics Before Investing

Every beginner should start by understanding what shares represent, how stock prices move, and the difference between long-term investing and short-term trading. You don’t need expert-level knowledge—just a solid foundation that helps you make informed decisions instead of emotional ones.

2. Choose a Regulated and Reliable Broker

The next step is selecting a licensed broker that operates under your country’s regulatory authority, such as the SEC in the U.S., FCA in the UK, or SEBI in India. A good broker provides a secure trading platform, easy account setup, and transparent fees, which ensures your investment journey begins on safe ground.

3. Open the Necessary Investment Accounts

Most countries follow a two-account structure for investing. You need a trading account to place buy and sell orders, and an investment or Demat account to hold your stocks and other securities in electronic form. Brokers typically bundle these together for convenience.

4. Deposit Funds and Start Small

After your accounts are active, you can transfer money using the payment methods supported in your region. Beginners should always start with small amounts of capital—money they can afford to invest for the long term, not emergency funds or borrowed money.

5. Begin with Long-Term Investing

The safest path for beginners is to focus on long-term investing rather than day trading or speculative strategies. Long-term investing allows your wealth to grow steadily through compounding, while protecting you from the stress and volatility of short-term market fluctuations.

6. Build a Simple and Diversified Portfolio

Most new investors benefit from starting with broad-based index funds, ETFs, or stable companies rather than chasing risky, fast-moving stocks. A diversified approach reduces risk and provides smoother returns over time.

7. Review Your Portfolio Periodically, Not Constantly

Checking your investment performance daily can lead to unnecessary fear or excitement. Reviewing your portfolio every few weeks or months is enough to stay updated without making impulsive changes.

8. Continue Learning as You Grow

The share market rewards knowledge and patience. Reading books, studying charts, watching financial news, or taking structured courses helps you understand market cycles, global events, and how different sectors behave. The more you learn, the better your decisions become.

9. Stay Patient and Consistent

Successful investing is not about timing the market; it is about staying disciplined, investing regularly, and letting compounding work in your favor. Consistency and patience are the two strongest tools a beginner can develop.

Common Risks in the Share Market

Investing in the stock market offers excellent long-term potential, but it also involves certain risks that every beginner should understand before investing money.

These risks are not meant to scare investors away—rather, they help you make smarter decisions by knowing what to avoid and how to manage uncertainty.

Stock markets across the world experience similar patterns of volatility, economic shifts, and behavioural challenges, so understanding these risks prepares you for global investing with confidence.

The following are the most significant risks that impact stock market returns.

1. Market Risk

This is the risk of the overall market falling due to negative sentiment, economic slowdowns, geopolitical tension, recession fears, or global crises. Even fundamentally strong companies may decline temporarily during market-wide downturns.

2. Volatility Risk

Stock prices move every second, and sudden swings can occur due to news events or investor reactions. Beginners often feel stressed during such movements and may make emotional decisions.

3. Company-Specific Risk

A company might face issues like poor management, high debt, declining sales, lawsuits, or product failures. These problems can sharply impact its stock price even if the broader market remains stable.

4. Liquidity Risk

Some stocks have very few buyers and sellers. Low-liquidity stocks can be difficult to exit at the desired price, increasing the chance of loss or delayed selling.

5. Regulatory and Policy Risk

Governments frequently update rules related to taxation, compliance, trading practices, and sector laws. Such changes can impact entire industries and shift valuations overnight.

6. Currency and Global Risk

International factors such as exchange rate fluctuations, trade policies, global supply chain issues, and foreign investor behaviour influence stock prices, especially for companies with global operations.

7. Interest Rate Risk

When central banks raise interest rates, borrowing becomes expensive for businesses, affecting profits and slowing growth. Higher interest rates also attract investors toward safer fixed-income instruments, reducing demand for stocks.

8. Emotional and Behavioural Risk

Fear, greed, panic, impatience, and overconfidence are often more dangerous than market conditions themselves. Emotional trading is one of the leading causes of losses among beginners worldwide.

9. Leverage Risk

Trading with borrowed money—known as margin or leverage—can magnify profits but also multiply losses. Even a small unfavorable price movement can wipe out an investor’s capital when leverage is involved.

Why the Stock Market Is Important for the Global Economy

The stock market is more than a place for individuals to invest—it is a core pillar of modern global economies. A strong stock market supports business growth, encourages innovation, attracts capital from around the world, and acts as a powerful indicator of economic health.

Whether in the United States, Europe, India, or any major financial hub, stock markets play an essential role in connecting capital with opportunity.

Understanding their importance helps investors appreciate how their participation contributes to broader economic development.

Below are the major reasons why stock markets matter worldwide.

1. Enables Companies to Raise Capital for Growth

Stock markets allow businesses to raise money directly from the public through IPOs and other equity offerings. This capital helps companies expand, invest in technology, create new products, acquire other businesses, and hire more employees. Without stock markets, companies would rely heavily on loans, slowing down global economic progress.

2. Creates Wealth for Individuals and Households

Millions of people worldwide invest in stocks to grow their savings and build long-term wealth. Rising stock markets increase the value of retirement funds, pension systems, index funds, and individual portfolios. This boosts financial security and improves overall living standards.

3. Attracts Global Investments

Stock markets draw foreign institutional investors (FIIs) and large global funds seeking growth opportunities. When international capital flows into a country’s market, it strengthens the financial system, increases liquidity, and supports local businesses. This interconnected flow of capital fuels global economic cooperation.

4. Supports Innovation and Entrepreneurship

Many of the world’s biggest breakthrough technologies—from electric vehicles and cloud computing to biotech and renewable energy—were funded through public markets. A healthy stock market encourages entrepreneurs to innovate, knowing they can eventually raise large amounts of capital by going public.

5. Acts as a Barometer of Economic Health

Stock indices such as the S&P 500, FTSE 100, Nikkei 225, and Nifty 50 reflect investor confidence and economic expectations. Rising markets often signal optimism about corporate earnings and economic growth, while falling markets may indicate uncertainty or slowdown. Policymakers, businesses, and analysts closely track market movement to assess economic trends.

6. Increases Transparency and Corporate Accountability

Publicly listed companies must follow strict reporting standards, share financial statements regularly, and comply with governance rules set by regulators. This transparency protects investors and promotes ethical business practices, stabilizing the global financial environment.

7. Provides Liquidity and Flexibility to Investors

The stock market allows investors to buy or sell ownership in companies whenever they choose. This liquidity makes investing more convenient and reduces the risk of being locked into long-term decisions without exit options.

Common Mistakes Beginners Make in the Stock Market

Many beginners enter the stock market with excitement but often make avoidable mistakes that lead to unnecessary losses. These mistakes usually come from a lack of knowledge, emotional decisions, or unrealistic expectations. Recognising these errors early can help new investors approach the market with more discipline, confidence, and long-term focus.

Below are the most common mistakes made by beginners worldwide.

1. Expecting Quick Profits

Many beginners view the stock market as a shortcut to fast money. In reality, successful investing requires time, patience, and a long-term mindset. Chasing quick gains often leads to taking excessive risks.

2. Following Tips and Rumors

Relying on tips from friends, social media influencers, or unverified groups is a major cause of losses. Such information is often incomplete, biased, or speculative, and beginners may end up investing without understanding the company or the risk involved.

3. Not Doing Proper Research

Some beginners buy stocks simply because they saw someone else buying them or because the stock is trending. Without researching the company’s fundamentals, financial health, and industry conditions, investors expose themselves to unnecessary risk.

4. Putting Too Much Money Into One Stock

Lack of diversification is a dangerous mistake. If all your money is concentrated in a single company or sector, your entire portfolio becomes vulnerable to that one investment’s performance.

5. Checking the Portfolio Too Frequently

Beginners often check their investments every hour, reacting emotionally to normal price movements. This leads to panic selling during dips or impulsive buying during rallies.

6. Averaging Down Without a Plan

When a stock falls, many beginners keep buying more just because the price is lower, without evaluating why it fell. Averaging down blindly can worsen losses if the company is fundamentally weak.

7. Entering the Market Without Understanding Risks

Some beginners invest without understanding volatility, economic cycles, or company-specific risks. Lack of awareness leads to poor decision-making during uncertain market conditions.

8. Trading With Emotions Instead of Strategy

Fear and greed are two powerful emotions that often control beginner behaviour. Emotional trading leads to chasing high prices, selling too early, or holding on to bad investments for too long.

9. Using Leverage or Margin Too Early

Margin trading amplifies both profits and losses. Beginners who use leverage without proper experience can wipe out their capital with just one unfavorable market move.

10. Ignoring Long-Term Compounding

Many new investors underestimate the power of compounding and focus only on short-term wins. Staying invested for years, not days, is what builds significant wealth.

Best Practices for Successful Investors

Successful investing is not about predicting every market move—it is about developing consistent habits, managing risk wisely, and staying disciplined over the long term. Investors around the world who achieve steady results tend to follow certain principles that protect their capital, reduce emotional decisions, and allow them to benefit from long-term market growth. These best practices are universal and apply to beginners and experienced investors alike.

Below are the most effective best practices that can help you succeed in the global share market.

1. Invest for the Long Term

Time is one of the strongest advantages an investor has. Long-term investing allows compounding to work in your favor and reduces the impact of short-term market volatility.

2. Build a Diversified Portfolio

Spreading investments across different companies, sectors, and asset classes reduces risk. Diversification helps ensure that poor performance in one area does not significantly damage your entire portfolio.

3. Start Small and Increase Gradually

If you’re new to investing, begin with small amounts and increase your investments as you gain more knowledge and confidence. This approach protects you from early mistakes and helps you learn at a comfortable pace.

4. Use Regular Investment Plans (SIPs/DCA)

Many investors follow systematic investment plans (SIPs) or dollar-cost averaging (DCA). These strategies involve investing a fixed amount at regular intervals, smoothing out market fluctuations and reducing timing risk.

5. Stay Informed but Avoid Overreacting

Understanding global news, earnings results, and economic trends is important, but reacting impulsively to short-term movements often harms returns. Focus on long-term fundamentals rather than daily noise.

6. Maintain an Emergency Fund

Before investing aggressively, ensure you have a financial cushion for unexpected events. This prevents you from selling investments at a loss when you urgently need money.

7. Avoid Emotional Decision-Making

Fear and greed can derail even the best investment strategies. Set clear rules for buying and selling, and stick to your plan instead of reacting emotionally to market swings.

8. Review Your Portfolio Periodically

Evaluating your investments every few months helps you stay aligned with your goals. It also allows you to rebalance your portfolio if certain holdings become too large or too small.

9. Learn Continuously

Markets evolve, new sectors emerge, and global conditions change. Consistent learning—through books, courses, financial news, or expert insights—helps you adapt and make better decisions.

10. Avoid High Leverage Unless Experienced

Using borrowed money magnifies both profits and losses. Beginners should stay away from leverage until they fully understand risk management and market behavior.

Final Thoughts

The share market is a powerful global system that connects companies needing capital with investors seeking long-term growth.

Although it may seem complex at first, its foundation is built on simple principles: businesses issue shares to raise money, investors buy those shares to participate in future growth, and markets allow these shares to be traded freely based on demand and supply.

Understanding how IPOs work, how secondary markets operate, how prices move, and how trades are settled gives beginners a clear picture of the entire process.

Along the way, investors must also learn about risks, develop smart habits, avoid common mistakes, and stay focused on long-term goals rather than short-term fluctuations.

With consistent learning, disciplined decision-making, and a well-thought-out approach, anyone can participate confidently in the global stock market and gradually build meaningful wealth over time.

Frequently Asked Questions (FAQ)

1. What is the stock market in simple terms?

The stock market is a global marketplace where people buy and sell ownership in companies. When you buy a share, you own a small part of that company and benefit from its growth over time.

2. How do stock prices go up or down?

Prices change based on demand and supply. If more people want to buy a stock than sell it, the price rises. If more people want to sell, the price falls. Factors like company performance, economic news, global events, and investor sentiment influence these movements.

3. Is investing in the stock market risky?

Yes, all investments involve some risk. Markets can be volatile, companies can perform poorly, or economic conditions may change. However, managing risk through diversification, research, and long-term planning makes investing much safer.

4. Can beginners start investing with small amounts?

Absolutely. Many people begin with small amounts and increase their investment gradually. Modern brokers allow you to buy fractional shares or small units, making it accessible even with limited capital.

5. What is the difference between trading and investing?

Trading focuses on short-term price movements and involves frequent buying and selling. Investing focuses on holding assets for years to benefit from long-term growth. Beginners typically find investing safer and more rewarding.

6. Do I need special accounts to invest in the stock market?

Yes. Most countries require a trading account to place orders and an electronic holding account (such as a Demat or custody account) to store your shares securely.

7. Are stock markets the same across all countries?

While the basic principles are universal, each country has its own exchanges, rules, regulators, taxation policies, and trading systems. For example, the U.S. has the SEC, the UK has the FCA, and India has SEBI.

8. Can I lose all my money in the stock market?

Losing everything is rare if you invest wisely, diversify, and avoid extremely risky strategies. However, poor decisions, emotional trading, or investing in weak companies can lead to significant losses.

9. How long should I hold my investments?

There is no fixed rule, but long-term investing—usually several years—has historically given more stable and consistent returns than frequent trading.

10. What should beginners avoid when starting out?

Beginners should avoid chasing quick profits, following random tips, trading with emotions, taking high leverage, and investing without research.

11. How much knowledge do I need to start investing?

Just a basic understanding of how markets work and how to evaluate companies is enough to begin. You can learn more gradually as you gain experience.